Hello Folks

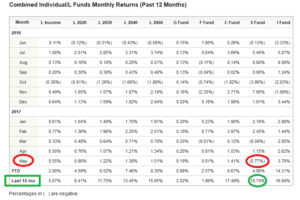

Well, it is about that time- Update Time, numerous folks have emailed me, WhatsApp’ed me, or just found me, and asked if the world is ending and why the market is going down. Some of the concerns are valid, others are reflective of an “always goes up” market which quite frankly has lulled some of us into a comfort zone. In this post I will attempt to explain what I believe is happening, and where I believe we are headed, at least near-term. First, well not first but before I go further, my TSP Allocation and Contributions of 50 percent C-Fund, 50 percent I-Fund remains unchanged.

The markets right now are policy-driven, not economics driven- I have said this numerous times on this site, and sadly I am being proven correct as we watch the markets decline. Policy-driven, but more correctly, politics-driven.

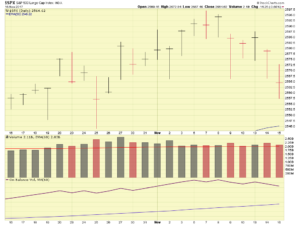

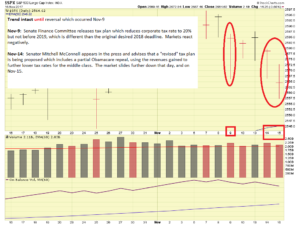

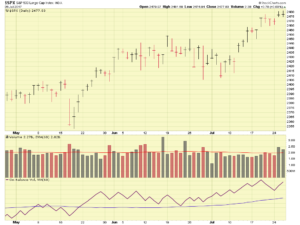

Below are charts of the SP 500 Index, my standard barometer to determine market health:

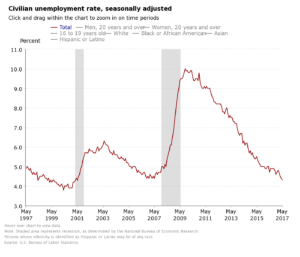

Apparent in the above charts is that the markets were on a fairly intact uptrend prior to Nov-9. Then what happened ? Did a report come out indicating that personal bankruptcies are at all time highs ? Huge unemployment numbers ? Poor retail sales data ? GDP data worsening ? None of the above. What happened, and is happening, is a lack of agreement in Congress.

On November 9, the Senate Finance Committee stated that the Tax Reform Plan would cut corporate tax rate to 20% no earlier than 2019, versus 2018, as originally believed. The markets sold off on that news, which served as a reminder that “everything is not as it seems” and that agreement in Congress is clearly lacking.

On November 14, Senate Majority Leader Mitch McConnell announced that a revised tax plan is being proposed, a plan that includes a partial repeal of Obamacare. If you want about a thousand search results on this topic, feel free to use Google and you will not be disappointed: numerous theories exist as to what impact a repeal will have to the economy. I will not attempt to dissect the approximate 1,000 opinions on the internet. But I will state the obvious: Yet again, we see discord in Congress.

A review of the charts above will reveal that sell-off volume is not super high, indeed some days it was above average, but we are not talking 50% or greater (150% normal) than average volume. The SP 500 is still above its 50-day Moving Average, a useful trend identification tool. Will the month close out with the index, and various TSP funds, in the negative ? Yes, this is possible.

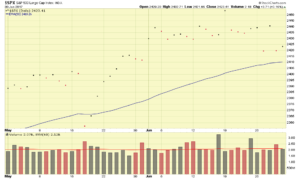

Should we worry ? I am not worried, not yet. A glance at the Gold Futures (Gold is historically a safe-haven investment for investment doomsayers) indicates that nobody is bailing out of stocks and into Gold. Gold prices are mostly flat (sideways) since mid-October. See chart:

My frequently broken crystal-ball predicts that our politicians will realize that lack of agreement is impacting both Wall Street and Main Street, and that an 80 percent solution is the best answer. “I win, you lose” is a binary model that should go the way of the Cold War. This approach needs to be abandoned in favor of “You win [some] and I win [some] – everyone wins”. My opinion.

Thanks for reading….

-Bill Pritchard