Good Evening

We are now 14 trading days past the post-debt ceiling agreement and all the indexes are doing well, for the most part. I say “most part” because the SP 500 Index has had trouble getting much altitude above the 1760 psychological level, first discussed in my October 25 2013 post. This sideways action (it is actually a very slight drift downward but in my opinion not a “downtrend” per se…) has commenced on October 29, when the index lost energy and started to go sideways.

See chart, with comments, below:

I am not overly concerned, because of two important things:

1. Historically, November and December are very good months for stock market performance, December being the best month out of the year, and November being the second best, out of the year. This is backed up by documented and historical data/studies.

2. The volume on the indexes during these recent sideways days has been mostly below average, indicating that there is money “on the sidelines” waiting for some sort of opportunity to buy stocks, and no major additional buying has occurred by institutional level managers (such as mutual fund managers at Fidelity, USAA, Vanguard, etc.) in recent weeks. My opinion is also that no significant selling has occurred either, by money already invested in the markets.

Note that we need buying to stimulate the markets, and propel stocks further upward. My opinion is the debt ceiling circus left a lot of folks tired and fatigued, and this possibly put a damper on some things. I have not seen downward price action, on above average volume, which is a red flag. However we must be vigilant at all times.

The C-Fund and I-Fund ended up outperforming the S-Fund in the month of October, however YTD, the S-Fund is still the top performer. I am a little skittish on I-Fund (even though it has given some good returns) due to my own admitted weariness with the never-ending fires and problems which seem to be arising internationally. I will give it one more week and possibly modify my TSP allocation, but at this point folks, these are minor tweaks, as we have grabbed the bulk of the years gains already, and I am sure everybody’s balances reflect that. In layman’s terms, we have been driving a Shelby Mustang all year long, and have won every race, and now we decided that we need it to go 10 MPH faster on the track, just “because”. I try to save my TSP movements for bona-fide, justified reasons, versus trying to pick up 1 percent here and there. I shoot for the long term trend, and I think we all accomplished that this year. More importantly, is the usage of G-Fund as a protection fund, as if you can mitigate your losses, and allow the gains to run, then that is the difference between stellar performance and lackluster performance.

Speaking of trends, and the importance to not fight them (also loosely categorized under “don’t buy dips”) is a story which came out regarding hedge fund Axial Capital Management, which had at one point 1.8 Billion dollars under management. Article and video provided by CNBC.

Axial had some smart folks onboard, no doubt, however it pays to not fight the trend, as Axial was primarily a short-fund / bear market fund in which it “sold short” stocks, which means basically it placed investments with the theory that they market would go down further. Which is great, when the market is indeed going down. However, as most of us know, this year the market has rallied with our own TSP showing 25 to 30% returns. Don’t fight the trend. Put the crystal ball away. Don’t try to outsmart the market.

Based on the news article, Axial will be shut down and closed for business, due to severe losses.

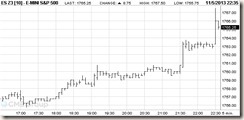

As I write this post, at 10:45 PM CDT, the night trading in the SP 500 futures has shown an abnormal jump upward, at 21:30 and 22:30, for reasons I cannot quite pinpoint. Asian markets are also trading positively (Asia is awake right now). If this continues into the morning, this may be a sneak peek into a positive trading day for US markets on Weds Nov-6. See chart to observe price jump, below:

I will continue to monitor things and in another 1-2 weeks, will advise if I make any allocation changes to my TSP account. If you find this site interesting or useful, please share it with your friends and colleagues. Thanks guys and have a great week.

– Bill Pritchard