Hello to all

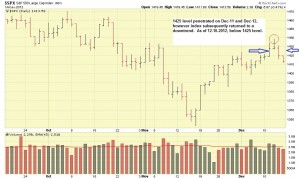

This past week the markets flashed some signs of optimism, and penetrated the 1425 level on the SP 500, which I had previously discussed was the “resistance level” for the index. See chart below

This occurred on Dec-11 and Dec-12, likely a positive initial response to the FOMC meeting and the fact that the International Monetary Fund agreed to additional aid payments to Greece (“publicly announced” on Dec-13). On Dec-12, in the morning, it climbed steadily and hit 1438, a new recent high over recent months. Absent additional information, this would be good news, having successfully punched thru the 1425 level. However, after the FOMC’s intentions were disclosed, the market quickly “sold off” and went lower on the afternoon of Dec-12. As of Dec-14, the last trading day of the week, the index has not recovered. Please see below 3-day chart, showing minute-to-minute “tick data” of the SP 500 index

Based on the above market behavior, and the inability to stay above 1425 for very long, I am still in G-Fund. Lets remember that midnight (or 11:59PM ?) on Dec-31 is the deadline for the Fiscal Cliff issues to be resolved. After that passes, mandatory tax hikes and other things go into effect. Obviously with negative market consequences. As a reminder, during Christmas week, very little volume will occur in the markets, as most money managers and traders will be off during that week. Any market moves that week (up or down) are questionable, as without sufficient volume, they are untrustworthy.

100% G-Fund for now. Thank You

Bill P

.