Hello everybody

On todays date, Nov-13, the SP 500 made a new 52 week high of 1782.00, and penetrated the previous 1775 overhead resistance level, which has existed since approximately Oct-29. Since Oct-29, until today, the index has frustratingly remained within a narrow 1755-1775 channel, ping-ponging back and forth between those levels. Today’s volume was average and nothing earth shattering, which is a disappointment in light of the new 52 week high. I prefer to see volume 25% or more, above and beyond the average daily trading volume, to really give me a solid feeling of confidence. The lack of volume is reflective that the new high may not be sustainable and the index may drift back down again. However “new 52 week highs” flashing across the headlines will stimulate optimism and lift people’s spirits, and possibly encourage more investing, so nothing wrong with that. Investors Business Daily newspaper, which is very credible and one of the tools in my toolbox, after observing today’s new high, has advised subscribers that the “uptrend continues.”

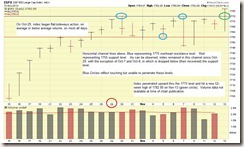

Let’s take a look at the chart below:

As far as the overall broader markets are concerned, today small cap stocks (represented by the S-Fund) outperformed all other stocks, with large caps stocks coming into second place (represented by the C-Fund). Emerging markets are on their 10th day of declines and this may be indicative of money out-flows leaving emerging markets and going somewhere else. Emerging markets are not represented by the I-Fund, which instead represents developed markets, but both have an international nexus, and most international indexes act in parallel fashion. As such,the I-Fund is underperforming, over the last couple of weeks.

Note: Anytime a stock or index goes down, it is because the supply/demand ratio of share volume reflects more selling than buying. So for whatever reason, the emerging markets have not done well for the last ten trading days.

One “roadblock” acting on the markets is the yet-again concern over QE tapering. I have discussed my hospital patient analogy numerous times here and once again, it is appropriate. By most indications (see Secretary Lew comments below for additional) , the economy is coming back, and what happens when we get good economic news ? People start to worry that the QE life support will stop. This in my opinion, is a roadblock to a renewed uptrend in the markets.

From a financial/economic news standpoint (as most know, I let the market itself tell me what to do…), we have had some positive news come out in recent days. While I don’t take news reports as gospel, I like to have a broad grasp on issues facing the economy and understand the overall climate of things.

Treasury Secretary Lew (a political appointee, who may be compelled to “present things” in a certain light…) reported that the US Economy is thriving. I concur that it is indeed getting better, as equities markets tend to act as a lead indicator on the economy. And the markets have been on a strong uptrend since January 2013. Readers may recall (available via search on this site) my earlier “field interviews” and intelligence collection efforts regarding economic activity, and I reached the conclusion earlier in the year that the economy was indeed coming back. I still feel this way today. In addition, our friends across the pond at the Bank of England are reporting that the economy in the U.K. is coming back.

In Nov-13 after hours trading, Cisco reported less than stellar financial performance this past quarter, and shares were down 10% in after hours trading. This is a huge move, as Cisco is a major NASDAQ component and member of the Dow Jones Index. Cisco shares (CSCO) may drag those indexes down on Nov-14 trading, which may falsely signal that the “markets are going down”. This is not the case in this particular example. Cisco was a internet-boom poster boy stock from the late 90’s, when it more than quadrupled in value. However today is not 1998 and I am not sure how many people go to Best Buy to buy a Cisco router anymore, to hook to their Windows PC (and then log into AOL) . In light of competition from other devices, technologies, and companies, such as Huawei , Cisco may be loosing its dominance.

At 10 PM Central Time, the SP 500 futures are trading higher than the day session, apparently ignoring the Cisco news. Lets hope that the daytime trading on the stock exchanges tomorrow (Nov-14) act accordingly, if yes, we may have a good day in the markets on Nov-14. See SP 500 futures chart below:

As of today Nov-13, my assessment of the markets reflects that the C-Fund has outperformed the S-Fund on a 30-day look-back period, however for a one week period, the S-Fund is resuming it’s strength and coming back. As already discussed, international markets (I-Fund) are underperforming. With hard chart data and my performance analysis, I combine documented historical data, which reflects that small cap stocks commonly outperform large caps in the months of November and December, assuming that the overall market is in a positive uptrend / “bull” condition (which it is). With that said, effective today Nov-13, I have adjusted my TSP Allocation to reflect 50% S-Fund and 50% C-Fund. This is due to my opinion that this allocation is the “best of both worlds” as we finish out the year, as both large caps and small caps are doing well. From mid-November forward, trading volumes start to dry up as Wall Street traders and financial professionals start to focus on the holidays and start taking time off. So basically mid-November forward, you will not see any drastic behavior changes, IE: one fund suddenly outperforming another one.

In summary: The SP 500 index hit a new 52 week high today, which is good news, however this was achieved on average volume. Ideally such moves are on above average volume. As such, the index may fall back down below its new high. Effective Nov-13, I am adjusting my TSP Allocation to reflect 50% S-Fund and 50% C-Fund. It is my opinion that no major red flags exist regarding the markets, but recent average volume levels and stagnation occurring at the 1775 level continues to be a challenge.

As always, thank you for reading, and please encourage your friends and coworkers to subscribe for timely and accurate market analysis and commentary. Hope everybody has a great rest-of-the-week and talk to you soon.

Thank You

– Bill Pritchard