Hello Everybody

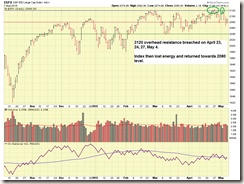

Continuing my current 100% S-Fund TSP Allocation, I am happy to report that for the first time ever, the SP-500 Index has finally closed above 2120, versus just break thru it, and settle lower, which it did on May 4. A “close price” is the final price that market participants have “settled on” by the time the markets closed for business, which is important for determination of sentiment. Lets take a look at two charts, showing “close only prices” reflected by dots. This is a less common method of displaying market activity, but still very useful. Observe my previously and often discussed levels at 2040/2080/2120.

The markets appear to be embracing the fact that the economy, while doing well, is not doing so well as to warrant interest rate hikes soon. Remember the public declarations made in front of Congress and in published policy statements by the FOMC, focused on both PCE Inflation data and Unemployment/Jobs data. Also remember Presidential elections are coming sooner and not later. I doubt any major deviations from these public statements will be occurring any time soon. Maybe, not impossible, but my opinion is we probably won’t see any rate hikes soon.

In my May 7 post, I opined on the pending May 8 jobs report: My opinion, the desired numbers are 225,000 to 250,000 jobs added and unemployment rate of 5.5 to 5.7%. The market should react very positively to those numbers.

The May 8 report was then released and reflected 223,000 jobs added, and an unemployment rate of 5.4%, very close to my personal estimates published prior to the report. As previously stated, the market has indeed embraced this data, resulting (finally) in a closure above 2120. NOTE: May and June historically are frustrating months, the kind where you pull your hair out, due to erratic price action. Knowing that indeed, this is “typical” behavior, I typically remain fully invested (versus “Sell in May” strategy). Unless of course additional red flags or storm clouds are observed. But a “rainy month” does not mean necessarily that a Hurricane is about to hit us, if one has historical patterns and data on hand. Some additional trivia is Aug/Sept/Oct are the markets worst performing months, historically.

On May 12, Greece adhered to their repayment schedule and made a payment to the IMF. While it is still questionable whether they will be able to make additional repayments, this May 12 payment was at least reassuring. In addition, Asian stocks have rallied, resulting in the first weekly advance in three weeks. This will likely benefit the I-Fund, which has exposure to Asian markets.

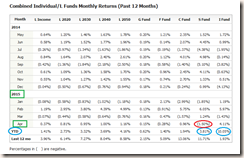

I may make a TSP Allocation change later this month to reflect 100% I-Fund or 50% I-Fund and 50% C-Fund. I will post any such change on this site.

At the present time, I remain 100% S-Fund. Thank you for reading and please continue to share this site with your friends and colleagues. Again, May (and June) are frustrating months, lets “hang in there” barring red flags or abnormal and negative market action.

Talk to you soon….

– Bill Pritchard