Hello Folks

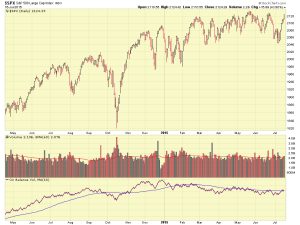

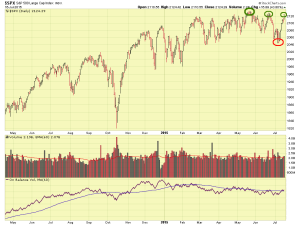

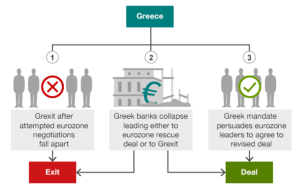

First, I remain 100% S-fund, even in light of some under-performance in the S-Fund the last few months. It appears that we got past the Greece situation but more hurdles have been placed in front of us, namely “China.” Before I go further, if you read my December 9, 2014 post, which describes basically the same thing that happened Monday July 27 (yes, we have seen this before), you will understand what is happening in China. But, my question is: does China really matter ? Many on Wall Street are having panic attacks that China’s economy is propped up by government efforts, such as easy lending and low-interest rates, similar to USA in the 2000’s, peaking in 2007 and then crashing hard. But if China did matter, why didn’t their markets behave in unison with the US markets, from 2009 to present ? I guess my question is “why [does it matter] now?” Lets look at a chart of the Shanghai Composite and SP 500.

What is immediately apparent is that the SP 500 has steadily climbed since 2009 (the mortgage and financial crisis was 2007-2009), while the Shanghai Composite has basically been sideways since 2009, only climbing in 2014 until present, at which point it started to crash. So my point is this: Since 2009, China and US markets did not act in similar manners, which typically occurs amongst global markets. Lets look at additional major stock indexes, notably the Nikkei Index (Japan), FTSE “Footsee” Index (London), and the German DAX Index (Germany/Frankfurt). While we study these indexes, lets agree that the prior US bear market ended in April 2009, and since 2009 has been in a uptrend. Actually the chart says that, not me. Observe how the other indexes (all major indexes above represent strong economies) behaved mostly in unison with the US Markets. The SP 500 is now placed first, and the Shanghai Index placed last, to provide for easier analysis.

So, again, since 2009 China was disconnected from other world markets (I don’t care why, as it just doesn’t matter, I care more about how to I act based on the information in front of me), and suddenly, now, China is crashing, and now, for some reason or another, the US markets “should” crash along with China ? Why now? It never mattered before. China’s bull market apparently got started in late 2014, and summer 2015 (nine months later) is now crashing. So our 6 year bull market “should” crash because China’s nine month bull market is crashing ? Maybe I am half looney-tunes to pontificate on this topic, but I think our recent sell offs are an over reaction to China. Note also that I could be dead wrong and our US markets could be in for a painful crash. I invite you to read my past posts however, and see how many times I have been wrong.

In short, it is best not to judge a market based on solely Monday action, so lets allow the week to play out and see how things look. I am cautiously optimistic and remain 100% S-Fund.

Talk to you soon….

– Bill Pritchard