Hello Everyone

Well it appears that Greece waved the white flag and agreed to economic reforms, thus receiving additional European Central Bank (ECB) monetary assistance and backing. While this is probably in the “then what has changed then?” category, it is important to note that this is the first time that the new Greek President and his team conceded that they indeed have issues and are agreeing to revamp things. Whether it will happen or not, is to be seen, but the markets liked it. As discussed in a prior post, Greece apparently “hit rock bottom” and finally admitted that a change of behavior is needed.

I felt fairly confident that this situation would be resolved, and thus did not bail out over to G-Fund. The seas got somewhat rocky, but fortitude sometimes pays rewards, at least when you “call it” correctly anyway. This time, my crystal-ball was right.

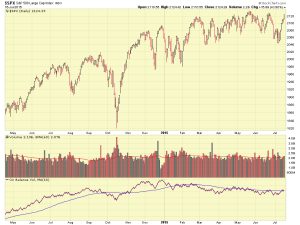

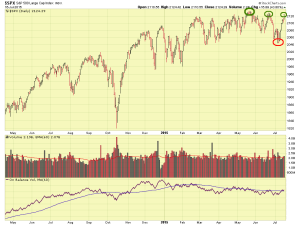

Monday July 13 and Thursday July 16 witnessed heavy buying activity/accumulation, reflecting a resumption of confidence in the markets by major funds. This past week, I-Fund outperformed all others, largely due to the relief over Greece (international stocks climbed), but in my opinion, I-Fund carries increased risk which I am not inclined to play with right now (that may change in the future). The S-Fund and C-Fund are performing almost equally, on a one-week to two-week look back. I remain 100% S-Fund at the present time.

2135 is the new overhead resistance level on the SP 500, a penetration of that reflects new All-Time-Highs and hopefully a new uptrend in the markets. We are away from the worrisome 2040 area. See charts:

That is about all I have for now folks. Again, things are starting to look positive… lets keep our fingers crossed. I am 100% S-fund until further notice.

Thanks for reading…..

Bill Pritchard