Hello Folks

In the “good news” category, on Monday Aug-10, the markets rallied strongly, erasing all of last week’s losses. The SP-500 Exchange Traded Fund (ETF), ticker symbol SPY, “gapped up” which is a bullish and positive sign. While optimistic, last week’s poor performance cannot go ignored, nor can my numerous emails in my inbox, which I will basically answer via this post. I have received quite a few questions, all reflecting nervousness over the past week in the markets- I hope to pacify and answer some of these questions here. Let’s get started with some history: The months of August and September are the worst performing months, market-wise, of the entire year. So get ready for some rough waters until we are out of September.

We must view the prior week’s performance thru that optic, the optic of historical poor performance. The rumored interest rate hike, rumored by those in the financial press to occur in September 2015 (the FOMC will meet Sept 16-17) remains front and center largely due to improving “jobs reports”, the most recent one having been released on Friday August 7, which reflected 5.3% unemployment rate. This “good news” is “bad news” for the potential rate-hike-camp, as it reflects an improving economy, one which may warrant a rate hike. On Monday Aug-10, FOMC Vice Chairman Stanley Fischer told Bloomberg News that inflation remains to be a concern and that a September rate hike is not assured yet.

This is not news for the subscribers of this free website, as I have discussed this very topic numerous times, actually five times, and only now is the FOMC starting to talk about this with the media. Bloomberg, CNBC, Marketwatch, have covered this topic only minimally. I have covered it five times already.

Allow me to discuss why I believe the Sept rate hike will not happen.

The September FOMC meeting is rapidly approaching. What is not so rapid is the movement of PCE Inflation data towards the desired 2% target. I have uploaded a .PDF file of the most recent FOMC meeting minutes, with important areas highlighted, and bolded, by me: FOMC-JUNE-MINUTES-2015

So, if we are to believe FOMC published statements and proclamations, we are “not there yet” regarding the PCE Inflation benchmark. We are at 1.3% on PCE Inflation, not 2%. Please see below graphics reflecting recent PCE measurements

Until we get 2% inflation as determined by PCE measures, no rate hike in my opinion.

Until we get 2% inflation as determined by PCE measures, no rate hike in my opinion.

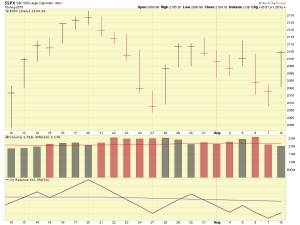

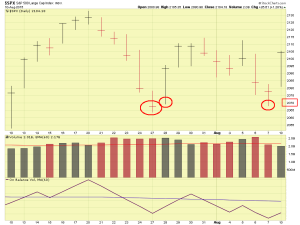

On to the markets: The 2070 area represents a support level for the SP 500 Index. We have had activity in and near that area since late July, until present, but the index has not gone below that level. Hence it is now “support.” See charts, representing the past 30 days of activity:

Fortunately, Monday Aug-10 trading got us up and away from the 2070 level. It is important to monitor this, as a return to this level is undesirable.

My current TSP Allocation remains 100% S-Fund. S-Fund is lagging the other funds and my goal is to simply be with the best performer; this appears to be I-Fund and next best is the C-Fund, on a 30 to 60-day look-back period. I indeed may change my TSP Allocation later this month.

Takeaways from this post are:

1. August and Sept are historically bad months, any down days should not result in panic attacks, absent additional information. Summer rain in south Florida does not mean that a Hurricane is imminent.

2. September interest rate hike is unlikely to occur, in my opinion.

3. A TSP allocation re-adjustment may occur in my TSP later this month.

4. PCE Inflation, not jobs data, is the FOMC’s roadblock right now.

That is all for now, thank you for reading. I remain 100% S-Fund. I hope everyone has a great week ahead.

Thank You

– Bill Pritchard