Hello Folks

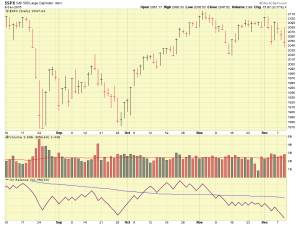

I am disappointed to report that the market’s action this week have reflecting additional selling, aka “distribution”, in the indexes, with the “Distribution Day” count now at eight, on the SP 500. As discussed in my October 14, 2015 post, Five or more days within 20 days can typically send the markets into a new downtrend. Again, we have had eight. I am further concerned that these distribution days were on rising volume. Note that the recent “Dow up triple digit” days, which many high-fived themselves over, happened on low volume, and without volume to fuel the flames, the fire will go out soon thereafter.

The flames are looking dim, at least this week. Lets look at some charts:

As can be seen above, my oft-mentioned 2120 level was never attained, and this was a very important trigger criteria as part of my decision to leave the G-Fund. Well, 2120 never happened, and I remain 100% G-Fund. 2020 is the new level I am looking at, which represents a support level, which the SP 500 index touched in mid-November. If the index breaks below this level, that is an additional negative signal and reflective of a pending Bear market.

What is causing this action ? Again, I hesitate to guess, and will not bury you in boring data, but 1) China and 2) US interest rates are the big reasons. Data continues to stream out of China which indicates that their economy is slowing down. China, with 1.4 billion people, is worthwhile to pay attention to. Compared to the USA, with 320 million people, China is quadruple the population of USA. Any recession or slow-down in China will impact other trading partners.

Regarding interest rates, the FOMC has finally started using phraseology to point towards a clear-cut action (whether it be raised, or do nothing, at least we have some clarity). It appears (and I would not be surprised) that rates will be raised at the December 15-16 meeting. If not, most likely in early 2016. What is troubling about a rate-hike in December, is that this is just before the Christmas and New Year holidays, a time when most of Wall Street goes on vacation, not to return until after the New Year. It could be argued that many money managers on Wall Street (if they are already not easing out of positions…) will hit the “sell” button, no questions asked, if rates are hiked, thus allowing them to go home during the holidays worry free.

Fellow trend follower and billion dollar+ hedge fund manager Stanley Druckenmiller, is also exiting positions, likely due to his own belief of an upcoming bear market. Lets take a look at a video from Bloomberg News, which happens to be a pretty reliable source of financial news by the way:

Apparently I am not only person with a conservative stance. With that said, lets monitor things and keep an eye on 2020 on the SP 500. Volume is very important: no volume, and the fire (either direction) will burn out. High volume, in any direction, will light things hotter and sustain the flames into that direction.

I remain 100% G-Fund. Thank you for reading and please mention this site, and forward these emails, to anyone who may benefit. The only reason I have multi-thousand subscribers, is largely due to word of mouth and the fact that you find value in The Fed Trader website. Again, thank you.

Talk to you soon….

-Bill Pritchard