Hello Folks

Mere days after my Dec-9 post, regarding deteriorating market conditions, a severe sell off was observed in all the indexes, with the Dow Jones Index shedding 300+ points on Friday Dec-11.

Some may recall that I went 100% G-Fund in August (I remain 100% G-Fund at the present time), and may remember my remarks in my August 23, 2015 post that

it takes months, not mere days, for a bear market to fully materialize

I remain committed to this statement, and flash forward almost four months later, we can see that the attempted rally from early October until early November, has grown weak. In numerous prior posts, I made reference to the importance of the 2120 level on the SP 500. This level is recognized by me to be a required trigger, prior to moving money out of the G-Fund. We can see that 2120 never happened, and by all appearances, will not be happening anytime soon. As a matter of act, the 2020 level, an important support level, was breached on Friday. See charts:

This was done on high volume, which means Friday was yet another Distribution Day. As oft-discussed before, numerous distribution days within a few weeks, in almost all cases, will kill the rally and typically send the trend into Bear market territory.

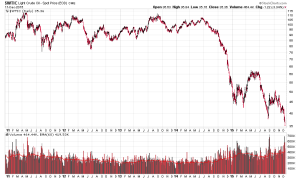

One causal factor, in addition to the looming interest rate hikes and Chinese economic concerns, is the dropping price of oil. In my opinion, buying oil investments right now would be akin to trying to catch a falling knife with your bare hands. Lets look at some charts:

As can be seen, Crude Oil is trading at $35 a barrel. One advantage that I have, being from West Texas, is access to folks who actually work and pay their mortgage via the oil industry, unlike traders in New York or Chicago watching a computer screen on Wall Street, who probably think a lowboy is a small child, a bobcat is a wild animal, tripping is when you step on your untied shoelace, and mud is what happens to your garden when it rains. I had one such industry professional at my house for dinner last weekend, who confessed that he was “concerned” about things in the oil industry. Prices per barrel, need to be $55, for the oil companies to make a profit and yet not result in super expensive gasoline prices for the consumer. This person felt that prices could continue lower, into the “sub-30’s” for price per barrel. We are at $35 now.

Regarding interest rate hikes, the FOMC meets this week, on Wednesday Dec-16, will announce their action regarding interest rate hikes. So let’s keep an eye out for that event. That is a pretty big deal- in my opinion, timing could not be worse, this meeting will occur just before a major holiday break by Wall Street traders and money managers. If rates are raised, these folks are going to dump shares, not “hold onto them and monitor things.” They are going to hit the sell button with both hands, and be “out” of positions so that they can enjoy the holidays worry free.

Again, I remain 100% G-Fund. I hope everyone has a productive and safe week…talk to you soon.

-Bill Pritchard