Hello Everyone

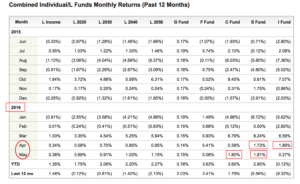

I am happy to report that my decision back on March 30, 2016, to return to the S/C Funds appears to have been the correct one. I am a little surprised that the I-Fund has performed as well as it has lately, but as I have said before, the I-Fund, with all of its potential for positive returns, comes with it an increased risk factor due to the international nature of the fund. With that said, lets take a look at the recent market action.

In my May 5, 2016 post, I discussed the “Sell in May” strategy and the historical returns (monthly) of the markets. As a short mini-review, the Sell in May crowd believes (admittedly they have the historic data to prove it) that since the markets typically go down in May, and typically don’t return positive until September, they “Sell in May” and take the summer off. I, however, being a trend follower, using my own self-developed proprietary methods, tend to just listen to what the market is telling me. This at times can be boring, and even seem lazy, with large periods of inactivity as we “wait for the market” to tell us what to do. In short, the market gave me no indication to sell in May, and I am glad I didn’t because the SP-500 and Dow Jones Index both had positive May performances, somewhat contrary to past history. This, in and of itself, is a positive sign.

Wall Street employs a lot of financial whiz kids who are busy analyzing earnings, fundamental value, balance sheets, and other stuff that I have no desire to research. At the end of the day, price and volume, are the only things that matter, period, the end. With that said, our “price” on the SP-500 has recently reached a 11-month (almost a year) All-Time-High, having hit 2120.55. See chart:

The last time the index was at these levels was July 2015. This behavior is bullish (good) and reflective of a continued uptrend. This action is in the face of recent concerns about interest rate hikes, however I have discussed on this site Ad nauseam that I don’t believe rates will be raised anytime soon (please take a look at prior posts). To add fuel to my argument is the recent news out of the Department of Labor that the US job market notched its weakest monthly gain in more than five years. It appears that Wall Street is starting to reach the same conclusion and feel that our economy is not quite ready for a rate hike. If companies are not hiring now, what will they be doing if rates go higher and the cost of capital and loans becomes more expensive ? Etc ?

The TSP Funds have done quite well since March 30, 2016, as demonstrated by this graphic:

My preliminary analysis reflects that the S-Fund remains the top performer (data as of June 8, 2016) on both a one-week, one-month, and 90-day look-back period. The I-Fund, interestingly, is starting to gain ground and is in second place behind the S-Fund. NOTE: At some point, I may decide to move a portion of my TSP into the I-Fund. However remember that the I-Fund carries additional risks. One overseas terrorist event, a Crude Oil panic, or a currency/debt crisis, could all erase those gains in the I-Fund.

For now, my TSP Allocation is 50% S-Fund and 50% C-Fund.

With that, lets talk about subscriber polls. I ask that you participate (participate once, using the honor system…) so that I can stay in tune with my readers and get a glimpse into their tastes/preferences regarding this site.

That’s all for now folks……Thank You for reading and talk to you soon….!

-Bill Pritchard