Hello everyone

My TSP Allocation and contributions remain the same: 50% S-Fund and 50% C-Fund. I will discuss the markets and economy in a bit, but allow me to “subdue” some fear over recent attacks on the federal retirement system. Dan Jamison, of the FERS Guide had great commentary in his May 8 newsletter – if you don’t receive it please sign up. Allow me to share some of my own opinion on this matter. The most recent effort to change things was led by OPM Director Jeff Pon, who took office as OPM Director on March 12, 2018; he subsequently sent a letter dated May 4, 2018, to outgoing Speaker of the House of Representatives Paul Ryan, in which he proposed numerous cuts and changes to our retirement system. It appears that current employees will not be affected, but that is not for certain. I have spent the last two weeks researching this topic and the following are my preliminary observations:

- Our retirement system (FERS, TSP, etc) is codified into federal law, Title 5 of the United States Code, and in other areas. To change this, Congress would have to do it themselves. The OPM Director can “want” but Congress has to “do”.

- It is not known or clear if the President himself can issue a unilateral directive and “make this happen”. Executive Orders cannot reverse what is already written into law. See #1

- To change federal law, a bill must be formally introduced. This has yet to happen. Most bills fail.

- Mr. Ponn’s letter includes proposals, nothing more.

- “Bipartisan Opposition” exists to these proposals per this article

- Mid-Term Congressional elections are in November 2018. Nobody is taking any action on this topic any time soon.

I also watched Mr. Ponn speak on video, at this video link here:

https://www.youtube.com/watch?v=9Isg36U8YbU

In this video, at timestamp 22:26 he states that the government spends $8.1 Billion in retirement every month, then at 22:42 he states that the government spends $81 Billion (eighty-one). It is unknown how 8.1 became 81. He also said 200 Billion at first, then said 200 million. He also testified May 16 at the GOP House Oversight Committee, video link here:

Check time stamp 55:06 where Representative Elijah Eugene Cummings provides feedback regarding the proposals.

In sum: Back to regular programming. As of today, no changes have occurred.

Lets move forward to what is impacting our TSP, the primary component of our aforementioned retirement system.

The general economy continues to perform strongly, a key indicator of economic health is unemployment data, and April’s report reflects that the unemployment rate continues to get smaller, currently at 3.9%. See graphic:

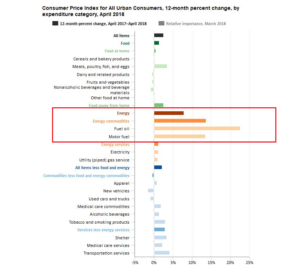

A touch of inflation indeed exists, however this is mostly fuel/oil driven- the price of gasoline impacts our pocketbooks, it is doubtful that as gas prices rise 10%, that anyone got a 10% pay raise, hence the inflationary effect, but most other categories remain stable, as measured by the Consumer Price Index. The most recent CPI data release is reflected by the below graphic:

The price of Gold, the world’s safe-haven currency, is at the lowest price it has ever been for all of 2018, reflecting the world’s appetite for buying equities/stock and refraining from investing in metals, a general indication in major institutional investor’s confidence in the world stock markets.

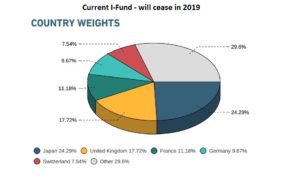

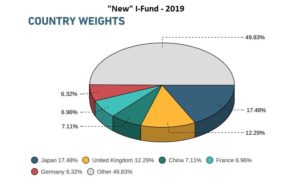

Note that I remain C-Fund and S-Fund, with no international exposure. The I-Fund has done well, but only marginally better than our domestic US stocks, and my personal stance is we may end up seeing 2018 year-end performance with the US stocks outperforming international stocks. Important to note is that the Federal Retirement Thrift Investment Board elected in November 2017 to change I-Fund investments. Basically, the I-Fund will stop tracking the MSCI EAFE Index, and instead track the MSCI ACWI ex USA Investable Market Index. In “english” this means that more countries are in the I-Fund, but why fix what is not broken ? I disagree with the FRTIB’s decision to do this. My opinion is that spreading your investment amongst additional holdings results in diluted returns. Let’s take a look at the current, and future I-Fund:

The new I-Fund will have Brazil, China, India, Indonesia, South Korea, Taiwan, Thailand. Which is great and seems like “more opportunity” to invest, until you realize with the exception of PetroBras/Brazil (gas), Alibaba (China), Samsung (South Korea), not much exists to invest in. Not sure what major company exists in Indonesia or Thailand. The FRTIB likely reviewed this decision closely, however I subscribe to the “if it is not broken, don’t fix it theory”, and subsequently think we will see lesser returns into the future.

That is all I have for now. Not much “stock market talk” but there really is nothing earth shattering to report on that front. May is a down month historically, don’t loose much sleep if the markets go down this month. A lot of tariff talk is out there, China apparently will be buying more US goods and seeking to rebuild trade relationships with the US. North Korea seems to want to come to the table and work with, not against, the US and free world, and thus pave a new way forward for their country. So we have a lot of things going on which could positively impact the markets, and our TSP. As stated before, my allocation remains 50% C-Fund and 50% S-Fund.

Thanks for reading and please continue to share my emails and website updates with your colleagues and coworkers. The positive feedback is overwhelming, I really appreciate the kind words and compliments, and am pleased that this site has raised awareness and enhanced the knowledge of literally thousands of TSP participants, in regards to the stock market and its direct impact on the TSP.

Have a great week ahead and talk to you in a few weeks.

-Bill Pritchard