Good Evening

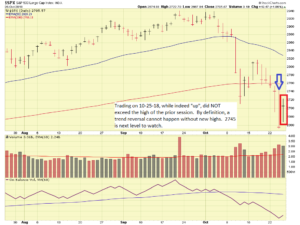

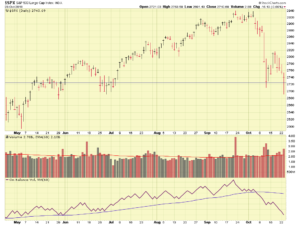

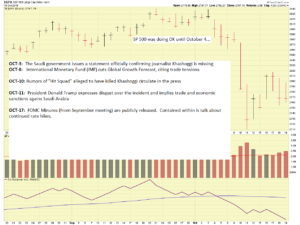

Just a short note, but in my opinion (everything on this site is all my opinion..) the market action on Thursday Oct-25 was “unimpressive.” I say this because most of the media was busy high-fiving each other and proclaiming that “the bottom was made” (in one day…) and “things are rebounding.” What they missed was that the high on the indexes did not exceed the prior day’s high. Had it done so (which it did not), I would have a different opinion. See chart:

Until the SP-500 is able to exceed 2745, a nice round number based off the Oct-24 high of 2742.59, my bearish stance will not change. By definition, a new uptrend must exceed a recent prior high, ideally on healthy volume, and with a “backdrop” of strong/improving fundamentals and positive/improving economic conditions. The current backdrop includes a cooling housing sector, some fairly big (and arguably well-run) corporations missing earnings (to include Amazon and Google), and some other flames appearing in the windows, indicating that things may turn to ashes soon.

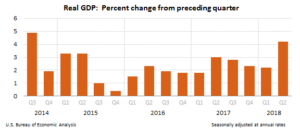

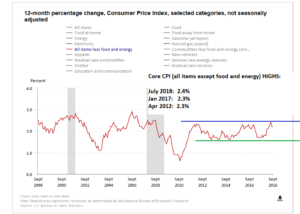

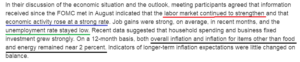

GDP Data will be released on Friday October 26, this is a Catch-22 situation, you can never win with GDP. A strong GDP is “good news” for the economy, but if anyone has read my posts back in 2014-ish, the recovering economy means the FOMC will raise interest rates, because the economy “can absorb the pain” and higher rates will “tame inflation” (another topic for another day). A weak GDP is “bad news” because it says things are slowing down, but this may prompt the FOMC to hit the pause button on interest rates. Long story short, GDP data is coming on Friday October 26 and the market could literally do anything in response. Most estimate that 3.4 to 3.6% GDP growth will be announced. President Trump has publicly stated that GDP will be “outstanding.” The prior GDP was 4.2%. See graph:

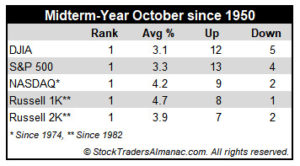

Again, just a quick note to summarize my views of the trading day, the day after the NASDAQ’s worst performance since 2011. Be cautious when you hear the market is “in a normal correction” (no correction is “normal”, if you catch the Flu every two years it is still not desired…), or that the “jobs reports” are still strong. Jobs don’t show bad news until companies repeatedly miss earnings, their stocks tank, then layoffs are announced due to “restructuring” and “redefining our business model”. So jobs are the LAST indicator to use if you are trying to anticipate market downturns. They indeed are good overall, long-term indicators of the economy. If full employment exists, then yes, things are good. Just be careful using unemployment numbers as a bulletproof, error-free, device to forecast the stock market.

Until next posting (when warranted…), thanks for reading and talk to you soon

-Bill Pritchard