Good Evening Folks

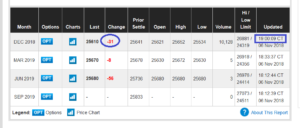

I got a few emails and messages from some who wanted to “jump back in” to stocks/stock funds when they saw the Dow Jones rally 545 points on November 7, the day after mid-term elections. The general mantra was “we are missing some gains.” However as it turned out, those “gains” quickly evaporated when the mid-term “pop” capitulated and reversed lower. On more than one occasion, I had to use a soft voice and soothe some skeptics, who believed stocks were going to triple the next day. The purported rally was viewed with suspicion by me, due to its lack of volume. It appears my crystal ball was accurate: Using closing data, the Dow Jones index is 793 points lower today compared to the Nov-7 close. Not exactly the “missed gains” some believed would happen.

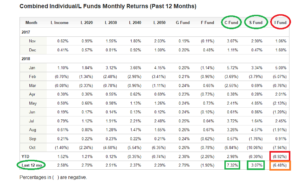

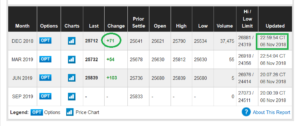

Before I go farther, lets talk about recent TSP Fund Performance. October was brutal, however a look at the chart will reflect that last 12-Month performance had the best gains in the S-Fund and C-Fund, two funds out of ten choices, that I have personally been in myself almost all year. The I-Fund performance was/is the worst fund Year to Date and last 12-months.

A review of various financial and investing websites (to include TSP sites) seems to theorize that this “downtrend” is merely a “hiccup” or “speed bump” and things are “not unlike a similar selloff in February.” However things indeed are different. The following facts were either not known/not on the horizon, back in February:

- Housing cooling off

- Interest Rate Hikes further along then February

- Corporate Earnings from numerous companies below expectations

- Tariff disagreement and threats of sanctions/counter-sanctions

- 30-year Fixed Rate mortgage rate presently at 7 year highs

- Numerous indicators reflecting a slowing economy

As such, in my opinion this downtrend is a new situation and possibly reflects a looming Bear market ahead. I mentioned in my Oct-23 post that:

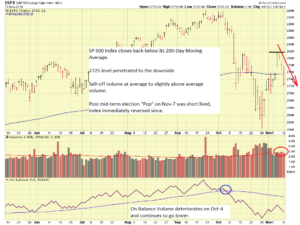

“…things may rally back up in the coming weeks, but the “smart money” will sell into this rally (if it occurs…), capturing some last-minute gains, but then, soon after, the bottom may fall out of the markets. A technical indicator, the 50-Day and 200-Day moving average, indeed reflects a possible downturn ahead…”

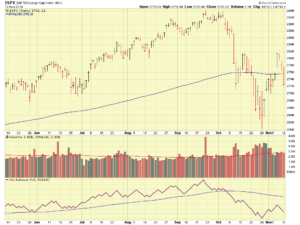

I still hold that belief, especially if agreement with China does not occur at the G-20 Summit, which begins Nov-30 (17 days away). Further compounding problems is a very probable rate hike by the FOMC in December. My crystal ball anticipates additional turbulence in the months ahead. Lets take a look at a chart of the SP 500:

Apparent in the chart is the fact that the Nov-7 “pop” failed, with the reversal of trend on volume which is average to slightly above average. The index is back below its 200-Day Moving Average, a negative indication.

In light of recent market behavior, and the previously discussed economic signals in the “background”, I remain 100% G-Fund in my personal TSP.

FYI that Core CPI will be released on Nov-14, this may serve as additional catalyst to send markets lower, if the number is 2.3% or higher.

Thank you for reading….talk to you soon….

-Bill Pritchard