Good Evening

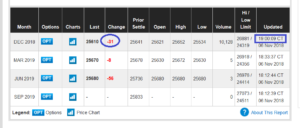

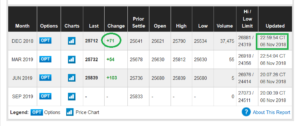

As most know, Nov-6 was the date of the Midterm Elections (unless you voted early). I have said in prior posts that the midterm elections is one of many trigger events causing stock market angst. My opinion is any power shift in Congress could potentially derail Pro-business efforts and pro-business tax policy. As of 11 PM Central Time, it appears that Democrats will take control of the House, and Republicans will have control of the Senate. The Dow Futures have responded positively to this, see table at 7PM and 11 PM:

Some studies exist that in cases with a Democratic House, and a Republican Senate, this is “good” for the markets but these prior cases are arguably (in my opinion) from a different era of politics, pre-Twitter, etc. I will not expand further but safe to say I believe the midterms are a point of concern for the markets. California Democrat Maxine Waters, an vocal critic of President Trump, is expected to become Chairwoman of the United States House Committee on Financial Services, which oversees the banking, securities, and other industries, to include the FOMC, which sets interest rates. Expect attempts to slow down rate hikes to be met with resistance by the new Chair.

Not until multiple days, post-election, will the “mood” of the markets be identified regarding the election. It is not known who is getting fired, subpoenaed, or what new investigations will be opened (and on whom) regarding the shift in Congress. Expect continued discussion of sanctions and tariffs against a variety of countries. Opinion: I would “monitor things” before making a decision on a new TSP Allocations.

Lets take a look at what has happened in recent days. The markets are in what is termed “Attempted Rally Mode”, in which they indeed have “up” days however volume is lagging, or below, the 60 to 90-Day average volume. To overcome prior sell-offs which occurred in October, the markets will need much more powerful volume. The markets have displayed six “rally attempts” so far. Ideally, a “follow thru day” occurs in the very near future, with volume greater than the prior day, with the index closing 1.7% or higher than the prior day. Without a “follow thru day” soon, the market will likely resume a downward direction.

Lets take a look at the SPY Exchange Traded Fund (ETF) as a proxy for the SP 500.

Some important economic reports will be released in coming weeks, CPI Inflation Data will be released on Nov-14, any Core CPI level 2.3% or higher will trigger renewed inflation fears and add fodder to the justification for interest rate hikes. Anything below would likely be embraced by the markets. Additionally, the FOMC will release an announcement on Nov-8 regarding current and future monetary policy.

In sum: I view the recent action with suspicion, due to the lack of volume. Numerous threats still exist in the landscape, notably a political power shift, interest rate hikes, and threats of tariffs and sanctions. With that said, I remain 100% G-Fund in my personal TSP Allocation.

Talk to you soon…..

-Bill Pritchard