Good Evening

As most know, the markets continued to crash this past week. Faced with the concerns of global economic slowdown, political uncertainty, rising interest rates, and an unknown tariff/trade situation, the market direction was not-surprisingly downward. Note that in late October, I made the decision to move to G-Fund: this resulted in some minor scrapes and bruises on the way out, but I am pleased to be in the safety of the G-Fund while things continue to fall apart two months later. Important to note that of all the various “TSP information sites” (Twitter, Websites, Etc) out there, this free one appears to be the only which correctly “called things.”

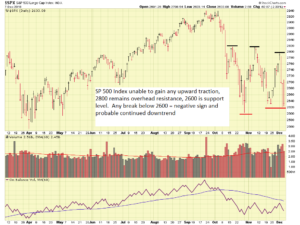

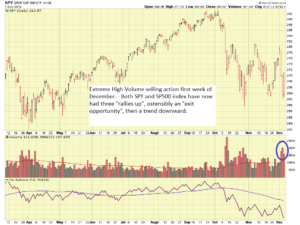

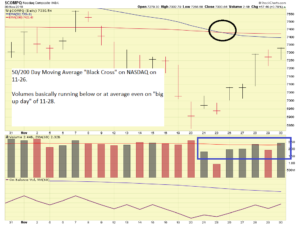

I made previous references to “the bottom falling out” of things, and apparently this has indeed begun. The S&P 500 index is at all time lows for the year, and has “broken thru” the 2600 support level. Additionally, the often watched “Bear Signal”, the 50-day and 200-day Moving Average cross, has occurred, on December 10. See charts:

A “supportive indicator” of my Bearish opinion is the price of Gold. Gold, a safe-haven currency, typically goes up when things are down elsewhere. Also, because of its safe-haven nature, moves in Gold typically don’t happen as a result from a one week stock market panic, or because Facebook stock crashes. Gold does not care about that. Historically (not all the time, no indicator is guaranteed to be perfect…) gold moves when the wide-ranging consensus amongst bankers, economists, hedge funds, etc. is ominous. Chart below:

Why is all this happening ? I offer only my opinion, and do not claim to have some sort of magical crystal ball or secret recipe, but as stated above (and in past posts…), economic slowdown, tariff concerns, and interest rate hikes are all causing angst. Ever heard of the company Federal Express (FedEx) ? One could argue that FedEx is probably one of the “always-will-be-there” companies, possibly more secure than the federal government itself. Lets take a look at their stock chart:

Apparent is the huge decline in the stock since January 2018, a loss of 40% in value. FedEx, n US company (Memphis, TN), however indeed has “global exposure” due to shipping all over the world. Some believe FedEx is a “proxy” for economic conditions. We know that oil prices are not impacting FedEx, oil is at all time lows for 2018: $47 a barrel. See Chart:

Cheap oil is fine for the retail consumer, mom and dad, who want to make that road trip, but big-picture wise, super cheap crude oil is bad for the industry. I wrote about this in January 13, 2017 , expressing that $55-$65 is the “happy spot” which keeps prices at the retail pump fairly cheap, while still allowing oil companies to make a profit (and keep workers employed; all of them buy houses, cars, and spend money). Many believe extended declines in oil are leading indicators for a recession.

On December 17, 2018, Houston Chronicle energy reported Jordan Blum echoed my sentiment that I made almost 24 months prior, stating that “…The dip below the $50 threshold places prices just below what’s considered necessary for most energy firms to make money…” Pleased to see industry analysts come to the same conclusion as me, I also believe that layoffs in the oil sector would be problematic for the economy. Why is oil crashing ? It is all supply and demand. If OPEC and other groups choose to “up” oil production, the supply grows, if they dial it back, supply comes down. Demand consumes that supply. If demand exceeds supply output, prices increase.

Regarding interest rates, the markets for some reason expected no rate hike in December, however as I anticipated, FOMC Chairman indeed delivered one. Right, wrong, or indifferent, it is what it is: a rising interest rate climate. Low (or zero) interest rates are the medicine for the sick patient. If the patient improves, the doctor reduces the medicine. The medicine reductions began on December 16, 2015 , as interest rates began their rise:

Note that we cannot eat our cake, and have it too. On one hand, we have politicians and others, bragging about the hot economy and “the great numbers coming in [data]” , but then we don’t like it when the FOMC raises rates, because, well, the patient is recovering and the medicine should be dialed back. I do not offer any solutions to this, interest rates and investment dynamics are a complicated matter, if you need to sleep, a 99 page Harvard white paper which you can attempt to decipher exists at this link.

Note that the markets will be closed on December 25 and January 1. They will be on a short trading day on December 24. As such, expect much lower volumes in the markets over the next two weeks. I too, will turn my attention away from the markets, and enjoy some family time during the holidays. Barring exigent circumstances, I do not plan on another update for another couple of weeks.

I remain 100% G-Fund. As a reminder, the G-Fund is an investment option if you would like to have all or a portion of your TSP account completely protected from loss. If you choose to invest in the G Fund, you are placing a higher priority on the stability and preservation of your money than on the opportunity to potentially achieve greater long-term growth in your account through investment in the other TSP funds. Additional official guidance published on the TSP site: https://www.tsp.gov/InvestmentFunds/FundOptions/fundPerformance_G.html

I wish everyone a Merry Christmas and Happy New Year.

-Bill Pritchard