Good Evening

I have had quite a few emails and LinkedIn Messages asking for my opinion on the markets. I simply cannot answer all of them, this is the very reason this site was launched years ago: mass/bulk communication of my views of the market. So with that said, allow me to share my views. Note that I remain 100% G-Fund and plan to continue that allocation for the near future.

The G-20 summit is “over”, and various news outlets and elected politicians are claiming “progress was made”. To be fair, the final vote is always Mr. Market, and (for now), the markets, reflected by the futures markets, like it, they are up over 400 points for Dow Jones Futures:

However one can only wonder if this “move” will last, much like recent other “up moves” which failed days later, dragging the markets down further. In support of that question, I offer the following about the G-20 summit:

Tariffs have not been eliminated (as many originally desired). The tariffs installed on $200B worth of Chinese goods, back in September, remain intact.

China/US have agreed to “keep talking” and have stated “we had a productive meeting” etc. These are pleasantries which means “we have not agreed on anything” and “we did not finish” what we needed to get started. Is it a “start” in the right direction ? Sure. Is the problem solved ? No. The can has been kicked down the road, for 90-days.

The FOMC will undoubtedly raise rates in December. 100%, absolutely, without a doubt. Their chairman, Mr. Jerome Powell, recently spoke in front of the Economic Club of New York. His statements in this social setting were somewhat differently toned that what we see in sworn testimony in front of Congress, or in official press releases. The statements at the meeting were devoured by hungry members of the media, with some even concluding that rate hikes are “on hold.” I guarantee nothing is on hold. Mr. Powell basically said what we already know, a close reading of the statement will reveal that. Furthermore, he even stated that rates are at historical lows. Guess what direction they will be headed ? Up. The press reported that rate decisions will be “data dependent” (they always have been). Well the data reflects a super hot economy, low unemployment, and inflation hovering at 2% (a previously identified “target” by former FOMC Janet Yellen). So the data supports continued rate hikes.

Moving forward, additional preliminary indicators exist that the housing market continues to cool (which happens when mortgage rates increase). The National Association of Home Builders recent survey reflects optimism is at the lowest point for all of 2018. Housing is a very reliable leading indicator regarding recessions ahead.

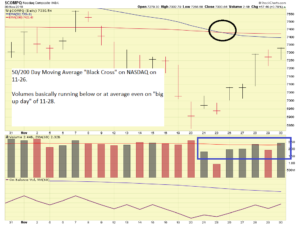

Note that the NASDAQ Index has witnessed its 50 day/200 day Moving Average cross, this is known as a “Black Cross” or “Death Cross” which means the underlying index is entering Bear Market conditions. See chart:

The SP 500 Index, my preferred barometer of things, does not reflect a cross yet, but it is approaching:

In conclusion, I will remain 100% G-Fund for now. As my disclaimer says, what you do with your TSP is your business. I still am not comfortable with the climate to wander outside and go back into stock funds, based on the above observations and opinions.

Thank you for reading ! Talk to you soon….

-Bill Pritchard