Hello Folks

As most know, markets have gone deeper into the red. The Dow Jones Index performed as follows:

12-7-18: -558.72 Points

12-6-18: -79.40 points

12-4-18: -799.36 points

12-3-18: +287 points (NOTE: this is the day after reported “successful” Sunday meeting with China at G-20, and numerous messages from readers of this free site, asking me “if we are missing gains” and “maybe I am delaying too long” etc etc, “the G-20 summit is over, now what” etc etc. “When are you gonna send out a new update?” etc.) The rest of the week these messages mysteriously ceased, as the Dow crashed.

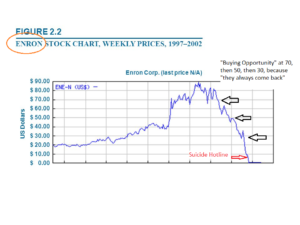

You may recall my evening post on 12-2-18, indicating why I am not comfortable returning to stock funds, as I prefer to continue to monitor things. The Dow subsequently lost almost 1,500 points by the end of the week, I would say my nervousness was (once again…) justified. Note I initially left the Titanic back in late October, and since then, things have not gotten any better. It is quite interesting to see “other” sites continue to claim that this is a “buying opportunity” and that “things always come back.” A frequently followed twitter feed of another site posted that “things are bouncing back soon” or something to that effect. I asked them what information they have to come to that conclusion, and my inquiry was met with (not shockingly…) radio silence. So for the majority of the folks in the press and on the other TSP sites, who apparently do not understand things, the easy answer is “do nothing” and “ride it out.” Because, well, this is a temporary hiccup, and “things always bounce back.” Sure, so do forests after a forest fire. However can you wait 10 to 20 years for your balance to recover ? I might add that I don’t think I have ever stated markets will never recover, if someone came to that conclusion, they do not understand my philosophy or are confused on my methods. My apologies on that. Lets take a look at a chart of Enron stock, I have inserted my comments onto the chart:

Enron went to zero (0) (value-less), and while the stock market indexes that our TSP funds are based on will never go to zero, the point to be communicated, at least in my view/opinion, is that capital (money) preservation and loss protection is critical. The G-Fund plays an important role in that strategy. No, I did not pioneer this idea, the official TSP site also supports it: https://www.tsp.gov/InvestmentFunds/FundOptions/fundPerformance_G.html

Enron went to zero (0) (value-less), and while the stock market indexes that our TSP funds are based on will never go to zero, the point to be communicated, at least in my view/opinion, is that capital (money) preservation and loss protection is critical. The G-Fund plays an important role in that strategy. No, I did not pioneer this idea, the official TSP site also supports it: https://www.tsp.gov/InvestmentFunds/FundOptions/fundPerformance_G.html

The “always bounce back” crowd is swiftly muted when you remind them of Enron, WorldCom, and other (admittedly extreme…) examples.

Lets discuss some recent market action…

As we know, the G-20 summit has concluded and one week later, nobody knows what was discussed or agreed to. This “messaging” by the involved parties (or lack of messaging) does not serve to allay already existing market nervousness.

Other concerns such as December interest rate hikes, as discussed in my last post, are almost a guarantee, also the mainstream press is talking about the Yield Curve getting flat and inverting. Note that I made reference on this free site to this topic months ago, in my posts dated July 15, 2018 and August 26, 2018. I even stated that the Yield Curve was one “leg” supporting the market, if it gets weaker, the market will go down. Here we are today, with a 1,500 point loss in the Dow.

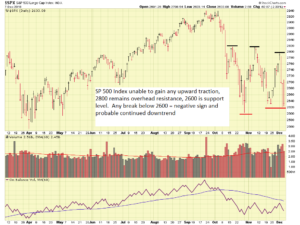

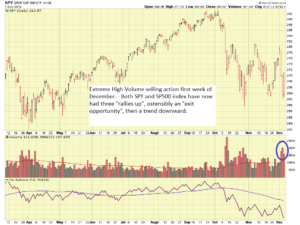

Lets take a look at some charts of the SP 500 Index, and SPY Exchange Traded Fund (ETF), a useful proxy to analyze volume:

Quickly evident is that the 2600 level is our support level for the SP 500, while 2800 is overhead resistance. Note ! This is a dynamic level and changes over time. These are current levels, and may not be applicable in six months. When I discuss levels like these, I am looking at the next 30-90 days. (Some reader emails have brought this up, hence the FYI). For now, 2600-2800 is our “zone” we need to watch, if the index goes above 2800, that is great, if it breaks 2600, that is bad.

Moving forward, let me promote my colleague Dan Jamison, CPA (and retired FBI Special Agent) of the FERS Guide. As some may know, the 2019 version has been published, and it is packed full of benefits information. I personally have great passion about the financial markets and watching the stock indexes, however my attention span tends to quickly drop off when the topics are annuities, life insurance, survivor benefits. Dan is the answer and explains things is awesome detail, and does so with fluency unmatched anyway else. Everyone should subscribe to his FERS Guide. Included on his site are articles by a fellow DOJ’er, Chris Barfield. These articles discuss the economy in general and common FERS topics, they are excellent and I learned something new from reading them. A screenshot is below:

Did I say that everyone should be a member/subscriber to Dan Jamison’s FERS Guide? Sign up is here: https://fersguide.com/

In conclusion, I remain 100% G-Fund in my TSP.

Thanks for reading…

-Bill Pritchard