Good Evening everybody

A long-awaited update, overdue somewhat (my personal TSP allocation of 100% G-Fund has not changed…) but I wanted to let the trade agreement come and go, and let the market respond, prior to this post. My lack of sleep from a new Beagle puppy in the household, who has decided that sleeping is for daytime and barking is for nighttime, has also impacted my evening writing time.

As most know, China is governed by the Communist party, has a long history of intellectual property theft (“IP Theft”), an even longer history of generally pirating and cloning everything from Back Street Boys CD’s to Tommy Hilfiger shirts, and routinely runs intercepts on our military assets operating in international waters and airspace, even causing the emergency landing of a US Navy EP-3 aircraft back in 2001. When they are not doing those things, they occupy a leading role (besides Russia and North Korea) in the cyber-criminal/hacking space. So the question of the day is, since when did anybody believe we could trust them ? On the other hand, by sheer volume of people (very smart people, no question about that…), they consume a lot of food and products, many of which originate in USA. Our major brands use Chinese labor to build IPhones and flat screen televisions. Indeed, a huge trading partnership exists, and ideally we all play nice in the sandbox.

I beg the question, as I amusingly watch mainstream financial shows and listen to “China experts” on talk shows: When did China become trustworthy ? The stock market (arguably) forgot their negative history above and rallied since January. Great if you were “on the train” but not so great when (and if) that train goes off the tracks. Note that with the Dow Jones loss of 617 points on May 13, we know that the market clearly is sensitive to the trade talks.

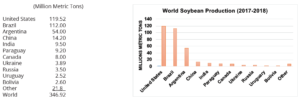

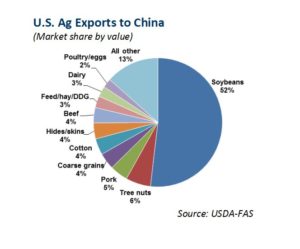

In short: the trade deal never got done. On May 11, President Trump stated China now has “another month” to get their act together, which my math puts June 11, 2019 as the next “deadline” (of many moved deadlines…) for China to come to agreement. China counter-strike retaliation on now-existing US tariffs is expected June 1. China has other measures too, it can simply elect to not purchase from US producers. This is potentially happening with US Soybeans, China’s largest agricultural import from USA:

China can (and probably will…) turn to Brazil, the worlds #2 producer of Soybeans, and tell them that “we are buying from you now” and tell US farmers to pound sand. The trade disputes have not helped soybean prices, they are at near 10 year lows of $8 per bushel:

The Soybean farmer clearly has not seen his retirement account grow much. No bull market for him, as supply begins to outnumber demand.

Our TSP does not trade soybeans, so lets move to stock market talk. However the above discussion is important- it serves as a reminder that not everybody in America is high-fiving themselves over the stock market rally, we have farmers and their families who depend on the US/China trade. Their situation could slowly expand into other parts of our economy if things are not resolved.

As discussed earlier (most of you know this, as reflected by the numerous emails, phone calls, cyber-stalking, and messages I get….when you have multi-thousand subscribers, you tend to get some “feedback”…), the market has rallied since January 2009. If you absolutely cannot stand the boredom of the G-Fund any longer, you might consider 50% G-Fund and 50% C-Fund. The C-Fund is the top performer since January, running closely with the I-Fund. I am not “advising this” or “endorsing this” etc etc: If you are dying from safety and boredom and you need a taste of the stock market, then you might review that allocation and decide for yourself. I remain 100% G-Fund.

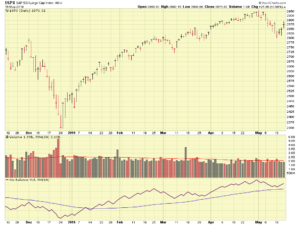

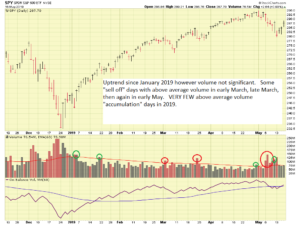

Lets take a look at some current charts of the SP 500 and the SPY Exchange Traded Fund (ETF) tracking stock, which is useful for volume analysis. My immediate observation is that the rally since January has been on lackluster volume, resulting in the theory that the stack of cards is easily toppled with the slightest wind:

If you read the comments on the above chart, you will understand the volume situation better. In light of the volume action and recent selling, the folks at Investors Business Daily newspaper (probably the only credible financial newspaper) have given the stock indexes a “D” rating, reflecting their belief that major funds are selling and exiting stocks. In additional news, the “Yield Curve” is now inverted. I have discussed this before, back in July 2018 , in summary a Yield Curve inversion occurred prior to all market crashes since 2000 (almost 20 years). Will it happen again ? Well, I don’t know. See below (Zero Line is “inverted” status on the chart):

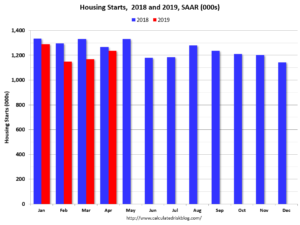

One piece of economic news the market celebrated this week was the purported “Great Housing Starts” news. By definition, “Housing Starts” is data collected when start occurs when excavation begins for the footings or foundation of a building. All housing units in a multifamily building are defined as being started when this excavation begins. With that said, the “positive news” was the fact that April starts were higher than expected.

This is fine but if you compare 2019 starts to 2018 data, 2019 is lagging, a possible sign that the economy is cooler this year than last year.

Keep your calendars ready for June, it will be full of events, all potentially market moving:

June 1: China activates retaliatory tariffs against USA.

June 11: “Revised trade deal deadline” US/China

June 18-19: Federal Open Market Committee (FOMC) / Federal Reserve meeting

June 28-29: G-20 Summit held in Japan. US/Chinese leaders reportedly may talk.

In conclusion, I remain 100% G-Fund. For those who need more excitement in their life, take a look at my opinions above regarding the C-Fund.

Thanks for reading and being a subscriber. If this site has enhanced your awareness of the markets, and you have a friend, coworker, or colleague who may find it informative, please share it with them.

Thank you and talk to you soon…

-Bill Pritchard