Good Evening

Bottom Line Up Front: Effective this evening, I will be making a change to my TSP Allocation, to reflect 50% C-Fund and 50% S-fund. Allow me to discuss my opinions regarding this change to my personal TSP.

Before I proceed, allow me to conduct some light discussion regarding some talk about being “too conservative” or “missing gains” due to G-Fund exposure. As has been mentioned numerous times on this site, the G-Fund is purposed to protect your account from loss, not designed to obtain great gains. Long term exposure, lasting a year or longer, while not desirable, may satisfy the TSP account holder’s risk tolerance, if the account owner has bonafide and good faith belief that there is heightened market risk to his account. Low rates of return aside (observe that capital gain is not the purpose of the G-Fund), the G-Fund remains the most popular TSP fund that exists.

Observe that the TSP plan uses the G-Fund heavily in the lifecycle funds, at times 70% allocation is witnessed in the G-Fund: the L-2020 fund distribution is: https://www.tsp.gov/InvestmentFunds/FundOptions/fundPerformance_L2020.html

My opinion is that numerous “headwinds” are now absent from the market landscape, most notably the US/China tariff war, and the Senate trial regarding the impeachment hearings targeting the President of the most powerful country in the world. On December 12, 2019, US/China reached an agreement in regards to tariffs, with additional tariff easing to occur on February 14, 2020. On February 5, 2020, the Senate trial mentioned above ended with an acquittal.

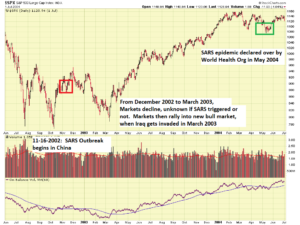

The only major issue impacting the markets, in my opinion, is trade issues associated to the Coronavirus, which has killed over 900 people worldwide as of today. Sad indeed, but it should be noted that over 59,000 humans die from rabies annually. I have never met a human with rabies, but statistics reflect a greater chance of meeting one versus a Coronavirus victim. Am I going to purposely travel to known Coronavirus locations ? No, nor would I enter an cage with rabid dogs. With that said, based on the above numbers alone, am I going to panic and worry about normal everyday life, because the Coronavirus is all over cable TV news and morning talk shows? Probably not. As such, I believe any market panic associated to the coronavirus is overblown. The SARS virus, another well known epidemic, dating back to 2002, resulted in minimal market response. Most academics cannot pin the market downturn in late 2002/early 2003 to the SARS virus, as the downturn was likely tied to post 9-11 issues facing companies and travel. Note that the markets indeed rallied subsequent to the March 2003 invasion of Iraq:

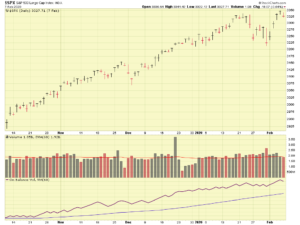

Let’s take a look at some charts of the SP-500 Index and the SPY Exchange Traded Fund:

Apparent is the fact that volume swelled in December 2019, consistent with the market embracing the tariff agreements, this continued until late January 2020, when the Coronavirus sell-off occurred, which then abated in early February. On February 6, 2020, a new All Time High occurred, when the SP 500 index reached the 3347.96 level. It then set another All Time High today, February 10, 2020, reaching 3352.26.

I see no headwinds for the markets in the viewfinder at this time. It is important to note that this is an election year- turbulence can be expected as we approach the Nov 3, 2020 election.

I will readjust my TSP Allocation to reflect 50% S-Fund and 50% C-Fund, due to my opinion that the market headwinds have dissipated.

Thank you for reading, hope everyone is having a great 2020 so far ! Talk to you soon…

-Bill Pritchard