Hello Folks

Bottom Line Up Front: Markets resume an uptrend while facing numerous challenges ahead. The following reflects my opinion based analysis of the market’s behavior in recent weeks.

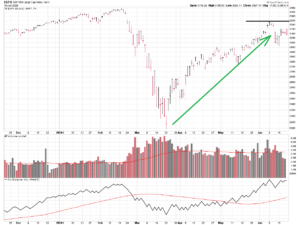

As many market watchers have observed, the markets have resumed an upward direction since approximately April 23, which coincides with various “reopening” activity across the country. This indeed is a good thing, however the volume behind the move upward has been lackluster (in my eyes), which tells me that institutional conviction is still largely on the sidelines. Furthermore, the price of Gold, a typical “safe haven” investment, is also up. This tells me that the investing universe is still not fully committed to stocks/equities, even in light of the reopen of the world. The S&P 500 index has approached its late February highs, but is encountering resistance at the 3250 area on the index.

Please see charts of Gold and the S&P 500 Index below:

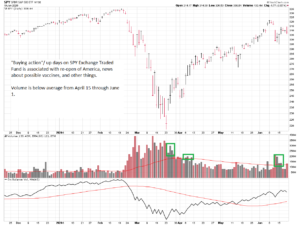

To analyze volume action, I typically employ the SPY ETF “tracking stock” which mirrors movement of the S&P 500 index. That chart is below:

Apparent in the chart are volume spikes, coinciding with reopening announcements, and on purported good news on the vaccine front. While welcome events, the market still has numerous hurdles ahead.

On June 8, the National Bureau of Economic Research (NBER) declared the US economy officially to be in a recession, based on the huge declines in employment and in production. Other groups classify a recession as two consecutive quarters, or more, of negative GDP. Our last GDP report on April 29 was -4.8%. The next report is expected to be released on July 30. If this is negative, then by all measures, the economy is in a recession. Interesting factoid is that William McKinley (deceased in 1901) was the last US President to win a re-election after a recession occurred during his first term. No President since has repeated that. What this means is political instability later this year may be another threat to the markets.

In addition to declining GDP, another barometer for the economy is the Chicago Business Barometer, summarizing current business activity, which is also known as the Chicago Purchasing Manager Index or Chicago PMI. The Barometer is considered to be a leading indicator of the USA economy. A recent chart of this barometer reveals that the current 32.3 level is on par with 2008-2009, a period of one of the worst economic downturns of the United States. Chart:

So we have two indicators, GDP, and Chicago Business Barometer, painting a stark picture of the economy. Additional action in the form of stimulus and tax cuts may be warranted, however with the Senate out until July 20, this may not happen for many weeks.

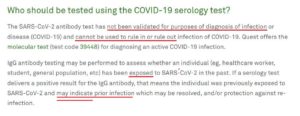

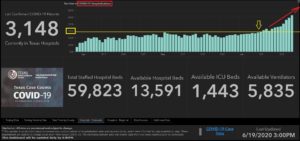

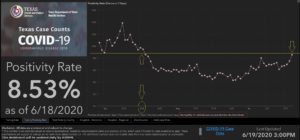

Other things threaten the markets, most notable is the Coronavirus/COVID-19 health pandemic. I will attempt to remain apolitical here, and use my home state of Texas as a discussion point. Texas, a conservative leaning, pro-NRA, largely Republican governed state, is the largest state of the contiguous United States, and has everything from beaches, ranch land, forests, and urban city environments. A variety of demographics exist in regards to residents of Texas. The way COVID is impacting Texas is probably not dissimilar to how it impacts the rest of the USA. With that said, death counts, and the positivity rate, is increasing in Texas. Not sure about other states, but Texas has stopped using antibody tests in the calculation of the positivity rate. Medical experts believe the viral test (nose/throat swab) is the best test for detecting current victims. The antibody test, merely checks for antibodies and proteins in your blood which may exist because of exposure to the virus. Ostensibly, one may be exposed, you body fights it off, and you never got infected at all. Should we lump this into the case counts ? I believe some states are indeed doing this, with the media not helping as they amplify and enflame the facts. Quest Labs themselves disclaims the use of their very own test for the purpose of ruling out COVID-19 infection:

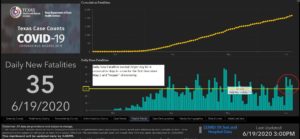

Some images from the Texas Department of State Health Services are below:

I am using Texas because I have faith in their reporting, there is no political angle to “spin” the reporting against the current administration, and they have removed antibody testing from the case counts. If anything, they have a possible tendency to “present” the information in a favorable manner. With that said, death numbers have increased, as has the positivity rate.

What does this mean? It means (in my non-medical opinion) that obviously COVID continues to infect others, even in light of social distancing, mask usage, and other measures. Big picture, this may result in restaurant closures, or another “shut down” either officially declared, or self-imposed, by the consumer. This will impact the economy, and the stock market. As we “re-open America”, we are likely to see increased infection rates. The goal is minimize impact on hospital resources, but if more people get infected, the need for hospital resources only grows. Fun fact: We don’t need ICUs or ventilators if nobody is infected.

In summary, the market is uptrending, but some challenges await ahead. Some big dates ahead include the “jobs report” on July 2, the return of the Senate to Washington DC on July 20, and the 2nd Quarter GDP report on July 30. When the Senate returns, we may see additional stimulus and economic measures which may benefit the markets.

Presently, the S-Fund is outperforming the C-Fund. Participants may want to consider this when making allocation decisions. My allocation of 75% G-Fund and 25% C-Fund, similar to an L-Fund, has provided me with the ideal risk/reward comfort level for the present time.

That is all for now. If you find this free site to be informative, please share them with your friends and colleagues. To subscribe, please use this link.

Thank you for reading ! I hope everyone has a great weekend and Father’s Day.

-Bill Pritchard