Good Morning Folks

Unfortunately, the markets continue to deteriorate, with (as stated in my prior post) the Omicron “new variant” and inflation taking center stage. This morning (Monday Dec-20), the Dow Jones Index is 600 points down, and the S&P 500 has “gapped down” on above average volume.

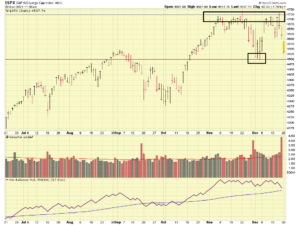

As you can see in this graphic, the “support level” for the S&P 500 is 4500, while the “overhead resistance” level is at 4725. The common definition of a “bear market” is when an index declines 20% or more from it’s peak price, so the following levels below (rounded) are important to watch. Often, once a market enters “bear territory”, additional investors throw in the towel and exit positions, further exasperating the situation…

Dow Jones: Peak: 36,566. Bear Level: 29,253

S&P 500: Peak: 4,744. Bear Level: 3,795

NASDAQ: Peak: 16,212. Bear Level: 12,970

Some additional indicators exist which I monitor daily, however a 20% decline from the peak is a widely accepted rule of thumb for a bear market. Thankfully, we are not close yet but it is important to be aware of. Whether you should be “safe” in G-Fund (per the TSP website, indeed an “investment”), or “buying cheap” in the stock funds, as they crash, is a discussion between you and you, my prior posts over the last ten years will reveal my personal opinion on that topic, I plan to cease regurgitating that topic anymore as strong opinions exist on both sides (which I respect).

To reiterate, the Omicron variant, and inflation (more Omicron in my opinion…) is spooking the markets. This was discussed in my November 28 post (South Africa reported Omicron to the WHO on Nov 24), and, well, here we are today three weeks later, with markets crashing.

I personally am optimistic regarding our economy and resilience in the face of these virus concerns, however indeed at the end of the day, the markets do not care what you, or I, think. They will do what they do. A positive observation I have is that South Africa has a huge case uptick but the death rates have not increased, at least not yet, and we are 3+ weeks into the new variant:

https://covid19.who.int/region/afro/country/za

So maybe, just maybe, this new variant, indeed highly contagious, has no severe impact to the victim. If this proves to be correct, the markets should respond accordingly and come back strong. “We should know something” by late January, which is two months after the discovery of the initial case. Back to G-Fund, should you bail out now before the eye of the hurricane hits ? Or should you wait, with the expectation that things will improve? Again, that is between you and you (and your professional advisors).

With that said, today is December 20, so allow me to say “Merry Christmas” to all my subscribers and followers. I wish you a safe and joyful holiday ! I will probably post again after the holidays.

-Bill Pritchard