Hello Folks

First post of 2023, because, well, there is just nothing to report or trigger a change from my current TSP Allocation, which remains 100% G-fund. I have been watching the S&P 500 index, and determined that the “4100 level” was the location where it needed to punch through, in order for a sustained trend to be deemed probable.

Sadly, it went through this level, then went back down. See chart:

If we look at the SPY Exchange Traded Fund (ETF), this allows us to see some volume trends a little better then the “big index” itself. Lets take a look:

As can be seen, the index went up slightly in January, then resumed down again starting in mid-February. “Wait, I see the TSP Funds had positive returns, 6-11%, in January. I am missing the action” you might say. Indeed they did, and no, you are not missing the action. My methodology is “capture large trends” not “daytrading your TSP.” If you want to try to predict each month’s performance, good luck. In any event, that 6% gain may vaporize if March continues to be a downtrend.

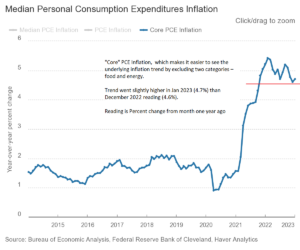

What is causing this market malaise ? Inflation x 100. Contrary to some who claim otherwise, inflation has not gone away, and I don’t know if it is “getting better” (it isn’t) or we are just becoming insulated to it. Lets look at the charts of the recent PCE (discussed widely, over the years, on this site) inflation data:

This inflation is impacting “morale” of the consumer, which is measured by the Consumer Confidence Index. Increased consumer confidence indicates economic growth in which consumers are spending money, indicating higher consumption. Not surprisingly, consumer confidence has been waning, see chart:

With that said, I simply have decided to remain 100% in the G-Fund, a fund contained within the TSP basket of funds and a TSP-endorsed investment choice. As I have said before, this “use the G-Fund to protect against losses” is not some magical Bill Pritchard invention or epiphany, it is something that the TSP official site itself discusses: https://www.tsp.gov/funds-individual/g-fund/

That is all I have for now. Again, I remain 100% G-Fund. 4100 remains an important level on the S&P 500. However we want “sustained existence” above 4100, not a one day blip or two day lucky streak.

Note: Some email systems are sending these updates to spam folders, others are blocking images. You may consider creating a filter “rule” that sends these emails to your inbox, which alleviates these issues. You can also go to the website address for the most recent update: https://www.thefedtrader.com/

Thank you for reading and please share The Fed Trader website with your friends and colleagues.

-Bill Pritchard