As mentioned in my prior post, the “CPI Report” will be released at 8:30 AM Eastern Time on May 10, 2023. The important data we are concerned with is the “Core CPI”, which is defined as the change in prices excluding food and energy prices, which tend to be volatile. While food and energy are, of course, major parts of any household’s budget, core inflation is often seen as a better indicator of the underlying pace of price changes.

The number tomorrow, representing April data. The various economic experts from the below institutions predict the following for April:

Comerica: 5.4%

Bloomberg: 5.5%

Cleveland Fed: 5.6%

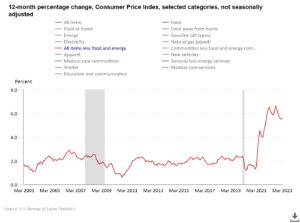

Chart of prior reports:

Note that the lowest number this year was in February, coming in at 5.5%. In my opinion, if April is not 5.5% or below, then the argument that inflation is subsiding, and thus interest rate hikes should slow, is out the window. In other words, a Core CPI above 5.5% will in most probability send the markets further down. Perfect world, we see 5.4% or lower.

Note that the lowest number this year was in February, coming in at 5.5%. In my opinion, if April is not 5.5% or below, then the argument that inflation is subsiding, and thus interest rate hikes should slow, is out the window. In other words, a Core CPI above 5.5% will in most probability send the markets further down. Perfect world, we see 5.4% or lower.

The link for the official release is here: https://www.bls.gov/news.release/cpi.toc.htm

Here is where to look for the Core CPI number (it will also be the hot topic all day long on CNBC….) :

Hope everyone is doing well- lets pray for a solid uptrend in the markets later this year.

-Bill Pritchard