Hello Folks

Preparing this post from my MacBook, so please forgive any font or graphics issues, the interface is slightly different from the Windows PC that I typically use.

On June 13, 2023, I submitted my request to the TSP site, leaving the G-Fund, and requesting a new allocation of 50% S-Fund, and 50% C-Fund. This is my first TSP fund change since 2021 (so much for those who claim that this site advocates “day trading” your TSP). A few reasons exist for this change, outlined below. Note that at all times I try to remove emotion from investment decisions, and use data and facts to guide me. This is harder than it seems at times…

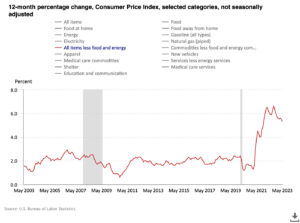

-Inflation is subsiding, albeit slowly. The Core CPI data (discussed in last month’s post) reflects that inflation is indeed coming down:

We have another inflation report coming out on June 30, 2023, the Personal Consumption Expenditures (PCE), however I believe that it too, will reflect that inflation is subsiding, or at least not increasing. Inflation is important, because the Federal Open Markets Committee uses inflation as a primary decision trigger for raising interest rates.

– “Implied Five Year Inflation Rate” as measured by TIPS or Treasury Inflation Protected Securities reflects that future inflation is expected to be lower:

– “Secondary indicator” of Gold (I always keep an eye on this) reflects that Gold prices are coming down from May 2023 highs, which (not coincidentally) is when stocks began to rally higher. This is possibly reflective of major institutions re-allocating investments back into stocks, versus gold. Again, “secondary indicator” sort of an back up to the back up kind of thing.

– The markets themselves are rallying. While I would prefer a more “broad based” rally, since about ten stocks are currently responsible for 90% of the S&P 500’s move upward, I must remind myself that it is a move nonetheless. These same stocks are also members of the NASDAQ, so surprise: The NASDAQ also goes up, and now we have a self-licking ice cream cone: The S&P 500 goes up, then the NASDAQ goes up, people then celebrate the market is going up and start to move into stocks, sending the markets up even more. At the end of the day however, the major indexes are up, and this is a positive:

You may recall earlier posts where I mentioned that “4200” was an important overhead resistance level for the S&P 500. Indeed it was/is, and the index broke thru this on May 26, 2023 (see Gold comment above). However I wanted to “monitor things” and ensure this was not a one-off boost of energy by the index. It was not: The index continues higher and has hit 4375.

Furthermore, the 50-day and 200-day moving averages have performed a “cross over”, a very time tested “bull market signal”. This has occurred on the Dow Jones Index, the NASDAQ, and the S&P 500 (see comments above about S&P 500 components also residing on the NASDAQ).

In conclusion, to reiterate, I am returning to the stock funds, 50% C-Fund and 50% S-Fund. This is what I am doing for my account, and is not investment advice.

Most healthy new bull markets last for years, so I am not losing sleep over the “timing” of this move. This new rally only really got started in mid-May. If my TSP request is activated tomorrow, or next week, I am not really concerned. My point is to capture long term trends.

FYI that some important dates ahead that may move the markets include:

June 14: FOMC Meeting concludes, interest rate decision. Most believe a “pause’ will occur.

June 29: GDP Report, this reflects measures the value of the final goods and services produced in the United States.

June 30: PCE inflation data is released. This, along with CPI, is used by economists to assess inflation.

Everyone have a great day. Remember, if you feel this site (or the emails…) help you understand the markets, please pass it to a friend or colleague and encourage them to sign up. Also, please use the TSP Help Line if you need help navigating the new TSP site.

-Bill Pritchard

Incoming search terms:

- https://www thefedtrader com/2023/06/13/returning-to-s-fund-and-c-fund/