Howdy Folks (Texas A&M-speak for “hello”)

First post in a few months, however in the “no news is good news” category, we have had no bad news to report. I will state that I am changing my personal TSP Allocation (standard disclaimers: this is not investment advice, etc.) to 100% C-Fund.

I will offer my analysis and opinion (did I say the standard disclaimer applies?) regarding the “why” behind this and what is fueling things in the markets. First off, my mantra is “price knows all” and at the end of the day, no matter what expert on TV, financial commentator, or FedTrader amateur stock guy says, we never want to try to outsmart the market. If you go rafting on the river, you can’t fight the current. To that end (or beginning?), the SP 500 has been on a very strong uptrend all year long, and the recent developments in Artificial Intelligence (AI) will (my opinion) propel its many tech related stocks farther upward.

If we look at the SP 500 (technically, S and P, but…) index, it is now basically a big “tech index” – https://www.slickcharts.com/sp500

Outside of the obvious chip stocks, we see many companies loosely categorized in the “science” category, and then you have energy companies. Arguably, this index has become a STEM (Science-Technology-Engineering-Math) Index.

My personal proprietary based system indicates that the top performer in coming months, out of the TSP funds, indeed will be the C-Fund.

Note that the SP 500 has hit new highs, hitting 5500 on the index:

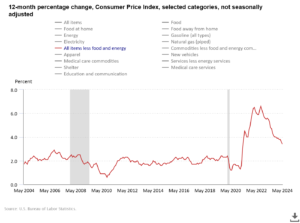

Fueling this is overall optimism in the economy, in which hard data indicates inflation (NOT COUNTING food and energy prices) is coming down. This has led to warm feelings that the Federal Reserve will continue to lower interest rates. Lets look at both PCE inflation and Core CPI inflation charts below:

Indeed, the summer has gotten off to a good start. Being one to always try to stay educated on TSP matters, I came across this article, published at Federal News Network: https://federalnewsnetwork.com/federal-insights/2024/05/how-to-maximize-your-tsp/

In it, they state: How to make a customized & optimized L Fund: First off, only use the C & G Funds. These are the only two funds which are worth it. Secondly, keep it simple:. You don’t need to worry about adjusting your C/G asset allocation ratios every single year. Follow this simple risk tolerance chart of our recommended re-allocation strategy.

Gee, I thought moving funds around in your TSP was an evil and a felony act. How many times was the flock told to “Ride it out” and “Set it and forget it.” I have talked allocation (NOT market timing…) since I started this site. Further unsavory was “using the G-Fund” as a tool in your tool box. Again, something I have supported for many years.

The article indeed is informative, please take a look yourself if you wish.

That is all I have for now. Again, I am personally 100% C-Fund until further advised.

Thank you for reading and please share with your friends and colleagues. If the graphics in this post do not appear, please go directly to the site itself: https://www.thefedtrader.com/

– Bill Pritchard