Howdy Folks

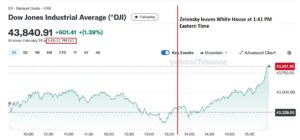

Well what a crazy day February 28, 2025 was. I will save the political commentary, but as we now know, the mineral rights deal between Zelensky and President Trump fell apart. Market wise, then what happened? The Dow Jones closed for the session 601 points up. See Chart….note that media puts Zelensky leaving the location at 1:41 PM Eastern Time:

Can one conclude that the markets are “happy” about this event, or are they smarter then we all are and are happy about something else. Time will only tell, and all we can do is trade the trend that the markets give us. Sadly, the markets, which celebrated President Trump’s huge victory in November, have had some stumbling lately, largely due to inflation concerns. My opinion is this deal will get done.

The S&P 500, my benchmark index, has drifted below (but gone back above), its 50-day Moving Average numerous times since December. While not a “red flag” it falls in the category of “pay attention.” See chart:

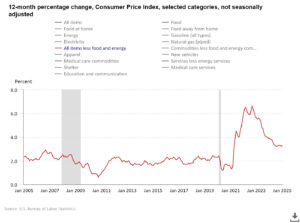

Recent Consumer Price Index (CPI) inflation data reveals that inflation’s downward trajectory (improvement) has flatted. As we know, the Federal Reserves “target” inflation number is 2% (they use the PCE inflation data but its almost the same…). In theory, as we arrive to 2%, interest rate hikes will stop. As we do not arrive to 2%, some argument is out there that interest rate hikes will return. So, the market is nervous about this. Please see most recent CPI chart:

Tariffs, which, depending what time of the day you watch Bloomberg, are good one day, bad the next, and I am weary of the different academic theorists and talking heads. In summary, if tariffs help US business, our stock market (in theory) will go up. If damage and suffering is done, on the tariff pathway, our stock market will do down. As the President is using tariffs as a tool in his diplomatic toolbox, some economic concerns exist.

According to the Federal Reserve Bank of Boston, an additional 25 percent tariff on goods from Canada and Mexico combined with an additional 10 percent tariff on goods from China could add as much as 0.8 percentage point to core (excluding food and energy) inflation. Remember my 2% comment above? 0.8 percent may not seem like a lot, but it moves the needle farther, not closer, to 2%. Entire business school departments cannot agree on what will really happen to the stock market after tariffs, so losing sleep over this is a moot point.

That brings us to the S-Fund, which I am 100% invested in at the present time. My “market calls” have an almost unblemished record, but strangely the I-Fund and C-Fund are outperforming the S-Fund for the last few weeks. I will monitor the situation, but we may see the S-Fund log a month or two of negative, or poor, returns. I am not moving anything yet, but dialing back a 100% commitment to S-Fund and instead choosing S and C, or C and I, may be something in my consideration for next month. Just an FYI.

With that said, we conclude this update. If the images or graphics do not appear, the direct link to this website is: https://www.thefedtrader.com/

Thank you for reading !

-Bill Pritchard