Howdy folks. I am not stupid enough to try to predict this very tight election, but I will offer some thinking points, something to add to your already overwhelmed sensory system with polls, surveys, rumors, podcasts, etc that are all covering this election. Not sure I am believing the polls, so lets go back to some Investigator 101 stuff and reduce this all to human behavior. At the end of the day, nobody knows how things will turn out. But, as always, a “market angle” and “human angle” exists…

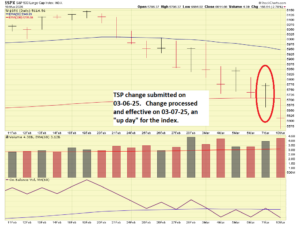

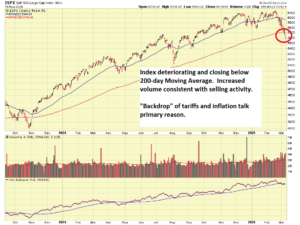

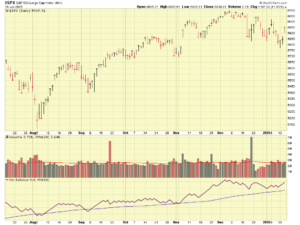

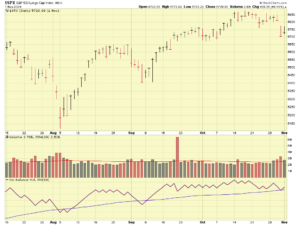

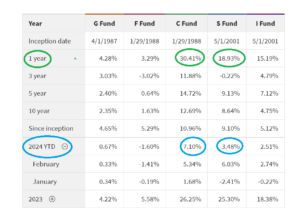

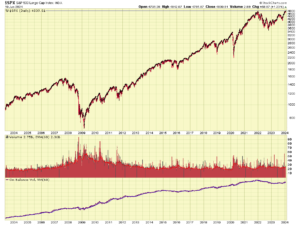

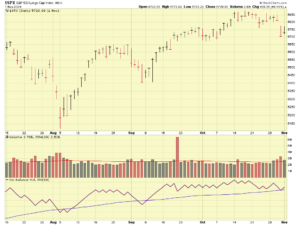

First, allow me to talk about the Presidential Prediction Indicator, developed by Sam Stovall. Historical (documented, proven, etc…) past performance of this indicator reveals that when the S&P 500 Index is in an uptrend, between July 31 and November 1, the incumbent party in the White House will keep the White House. Lets take a look at the chart:

Regarding the election itself, GOP strategist, Fox News contributor, and pollster Frank Luntz recently stated that 1) if Donald Trump wins either Pennsylvania or Michigan, he’ll win the election. 2) if Kamala Harris wins either Georgia or North Carolina, she’ll win the election. Note that he says “or” not “and”. So Trump needs PA or MI, Harris needs GA or NC. Roger that.

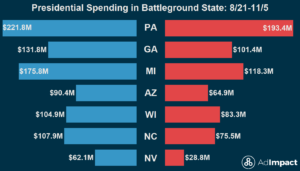

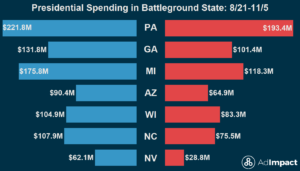

If we look at advertising spending by both campaigns, we see this, courtesy of Ad Impact Politics:

In this case, we see that spending is most in PA, GA, and MI. So lets take a look at these (apparently) important states.

PA:

Picked a Democrat for the White House in every election since 1992, with the exception of 2016 (Trump). Biden took PA back from Trump in 2020. State votes chose current Governor Shapiro/member of Democratic Party, and largest city, Philadelphia, has had a Democrat mayor since 1952. Current Mayor is a Democrat. Next largest city, Pittsburgh, their mayor, elected by voters, is a Democrat. Pittsburgh has had Democrat mayors since 1934. Governors have bounced between Republicans and Democrats every few elections. Demographics in PA have changed over recent decades, according to this 2020 article, Philadelphia itself is the second city with the largest Puerto Rican population, surpassed only by its neighbor New York City.

GA:

Picked Republicans for the White House in every election but two, since 1992. Governors have been reliably Republicans. However, interestingly, every mayor of Atlanta, the states largest city, has been a Democrat. The second largest city, Augusta, also has a Democrat mayor and a past history of electing local officials loyal to the Democrat party.

MI:

Put a Democrat in the White House every year since 1988, except for 2016 (Trump). Biden took the state back in 2020. MI Governors tend to rotate from Democrat (current Governor is Democrat) to Republican and back to Democrat every other election. Voters in the largest city of Detroit elected a Democrat mayor most recently, and that city has had Democrat mayors every election since 1962. The next largest city, Grand Rapids, has historically been Democrat leaning.

NC:

Reliably puts Republicans in the White House every year since 1980, except for 2008 (Obama). Interestingly, the current NC governor is a Democrat, however it appears historically both parties have occupied the governor’s house on a fairly equal basis since the 1970’s. The current Mayor of Charlotte, the largest city, is a Democrat, as is the mayor of Raleigh, the second largest city.

In summary…

So that is a brief snapshot of the most important states in the election, in my opinion the hardest state for Harris to win will be GA. In my opinion, the hardest state for Trump to win will be PA, due to strong Democrat-leaning metro areas historically, and prior patterns of sending Democrats to the White House.

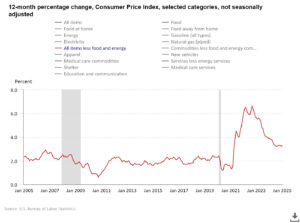

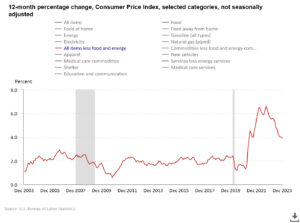

Goldman Sachs researched prior elections and they say this: First-term incumbency typically provides an advantage — unless there’s a recession during or just before the election. When there is no recession, the incumbent has always won in the post-World War II era.

Polls aside (who answers calls from unknown numbers, or actually responds to these texts?), past human behavior tends to be fairly predictive of future behavior. By looking at state and local election activity, we are able to see how voters in those areas vote, not to mention State patterns of who they send to the White House.

With that said, I conclude tonight’s post….the most important poll of all, the election, is days away.

-Bill Pritchard