Hello Folks

Hope everyone has been doing well. Subscriber-ship has really taken off since the “crash” back in late August, thank you for the interest in the site.

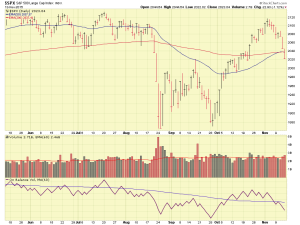

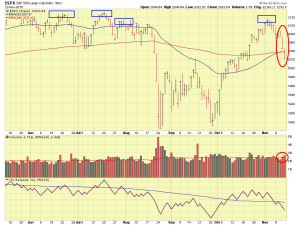

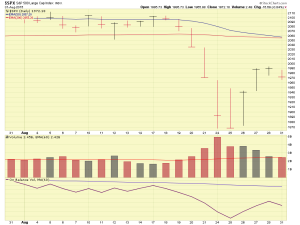

Let me get started by saying that I remain 100% G-Fund. This is due to my ongoing concern regarding weakness in the markets. As many have pointed out to me, the markets indeed have tracked upward, however, this vector upward has (in my opinion) lacked sufficient volume to sustain anything. An interesting note is that I submitted my TSP change to G-Fund on August 23, however due to the typically delay time in processing my request, and the subsequent up-tick in the markets after August 24, I did not exit “at the bottom” as one would believe. I exited on an uptick. The markets since have been mostly flat however. Lets take a look at the SP 500:

A few things become apparent after viewing these charts. 1) The overhead resistance level for the SP 500 is 2000, if we can get thru that, then I consider that a positive sign. 2) Volume since August 24 has dropped off. We have had no significant volume, on “up days”, at all.

Yes, we have had some days in which the volume was slightly higher than the prior day, resulting in some folks to celebrate, to include Investors Business Daily newspaper. This publication 99.9% of the time is a solid and credible source of info, however via Twitter, I disagreed with a prior opinion piece they posted regarding a celebratory article on volume (they never replied back…). In my opinion, the volume on the indexes is not high enough to warrant a jump back into the stock funds.

Combine the behavior of the markets themselves (the best signal of them all) along with the historical fact that the bull market (we are arguably in a correction now, but not full “bear mode”) is six years old, in addition to the above volume, my subsequent decision is to remain in the G-Fund. I want the market to “prove to me” why I should return to stock funds, so far, it has not.

As many know, the FOMC is meeting on Sept 16/17, with a press conference planned for 2PM Eastern Time on Sept 17. My opinion is that we do not see a rise in interest rates at this meeting. I have been wrong before, and I will be wrong again, but my position is based on the fact that in numerous public statements, to include some before Congress, the FOMC is using two factors to decide interest rate hikes: Unemployment/Labor Data and PCE Inflation Data. For in-depth discussion of this, please see my March 12, 2015 post.

While the most recent data reflects that the labor market indeed is at the levels desired by the FOMC (in order to raise interest rates), the PCE Inflation Data is not. 12-month PCE Inflation as reported by the Dallas Federal Reserve is largely unchanged since January 2015. Some believe that continuing to hold rates down is hurting things, and some pressure on the FOMC exists to just “get it over with” and go ahead and make the rate hike, which is a paltry .25%. Many also believe that the tension and stress around the possible rate hike is more painful than the hike itself. In any event, my opinion is that we do not see rates increased on Sept 17.

In the “Other” category, some things not TSP related but indeed related to your financial situation: Something most folks I know (or at least the ones I hang out with…) are not aware of: The Blue Cross Blue Shield Wellness Benefits Gym Membership benefits. The link is at: https://www.blue365deals.com/healthways-national-standing-25-monthly-fee-access-network-9000-gyms-nationwide

Take a look at the link, as I don’t want to misquote things, but long story short, it is $25 monthly gym membership per adult family member (if you have a family, your spouse needs to pay $25 in addition to the $25 employee membership, $50 total, and no child membership or plan exists….unless I read it wrong…), for access to numerous gyms across your city. For example in Dallas, my membership gives me access to all LA Fitness and all Anytime Fitness (two different companies) facilities.

Another item of importance is the FEGLI Federal Life Insurance open season, from Sept 1 2016 until Sept 30 2016. The most recent open seasons were 2004 and 1999, so you might take a look at this. FEGLI is more expensive than other programs, but FEGLI is one of a few life insurance programs that will pay no matter how, or where, you die. Sad as it sounds, it will pay in a suicide and pay if the death is in a war zone. Not many (none that I have found to be exact…) life insurance programs will do this. In the read the fine print category, if you have a non-FEGLI life insurance program, and you fly around on government aircraft, and/or get deployed to war zones or similar, you might want to check your policy. When do you need life insurance ? I am not a financial advisor, however big media types such as Suze Orman and Dave Ramsey seem to advocate to have life insurance until your oldest child is 25 years old, the theory being by that time, they are out of college and/or somewhat can live on their own. Do your own research, as I am not a financial advisor or insurance person.

That is all I have for now….I remain 100% G-Fund.

Thanks for reading and please continue to share this site with your friends and co-workers.

– Bill Pritchard