Hello everybody

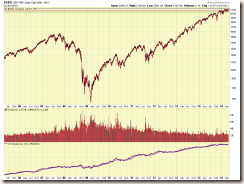

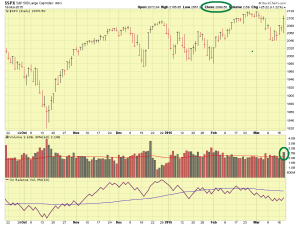

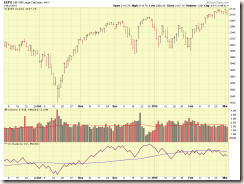

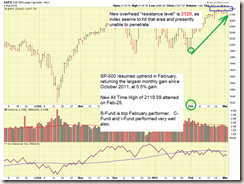

I received some emails regarding a “Status Check”, I am alive and well, thank you, however the only thing to really report is “more of the same” as the markets remain in a sideways range, bound by (SP 500) 2120 overhead resistance and 2040 support, with 2080 the “mid-point” between the levels. See charts:

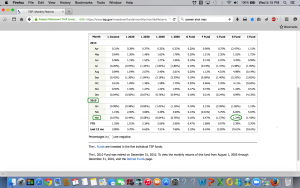

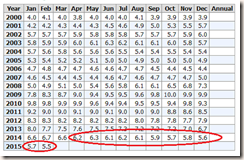

I am happy to state that the index has traded at or above 2080 since late March, reflecting an improvement in the health of the trend. With a little luck, we get penetration of 2120 and thus a likely new uptrend. I remain 100% S-Fund and see no underlying economic problems or market signals causing me to leave S-Fund. From a pure performance perspective, I-Fund appears to be taking the lead, however, if and when the US stocks breakout, their performance could start to outperform I-Fund. So I am hesitant to use a TSP move (two a month limit) only to have to change course soon thereafter. In is my opinion that the S-Fund offers the ideal risk/reward tradeoff right now. However we may likely see I-Fund to be the best performer in April once the data is calculated.

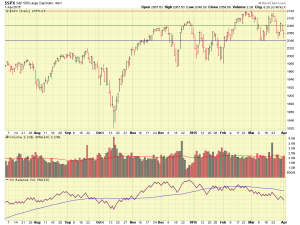

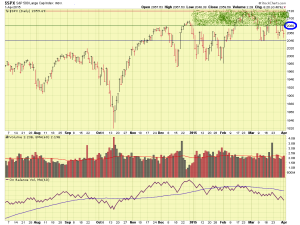

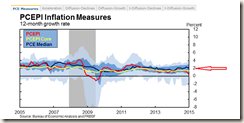

I will touch on some “background news” affecting things and report that China Central Bank will be easing its policies and relaxing credit requirements, due to a cooling economy in China. This action, announced Sunday April 19, is not hugely different from our own Quantitative Easing which began in late 2008. It could be argued that our QE program was largely responsible for the current Bull Market, and using that logic, a similar program in China may lift the Asian markets in a similar manner. Lets take a look at the SP 500 chart and observe the trend reversal in early 2009:

Academic theory and complicated economic explanations aside (and plenty are out there…) about whether QE “should” exist or not (we are printing money, easy money, artificially propping up the economy, etc. are all terms thrown around), if the end result is a market uptrend, I am going to go try to make money off the uptrend while everyone else argues the value of the program. I will be monitoring the “Chinese QE” (expect mainstream media to embrace this term – but to be clear, their program is similar in spirit, but not mechanism, to our QE) and looking for profit taking opportunities. The I-Fund, which duplicates the MCSI EAFE index, will likely benefit from China QE, due to that index’s exposure to Asian markets.

That’s about all I have for this post, again, I remain 100% S-Fund. As discussed, I-Fund will likely outperform all funds for the month based on my calculations, however entering I-Fund right now (for me) carries some risk, due to the Greece situation (payment to IMF due in May) and some other things that are going on. I may move to the I-fund next month. Standby for that.

Thanks for the great emails…please continue to share this site with your friends and colleagues. Talk to you soon everybody

– Bill Pritchard