Hello Everyone

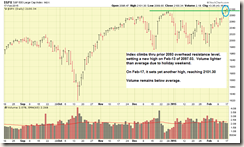

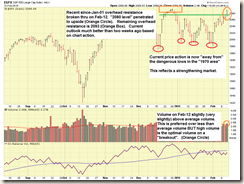

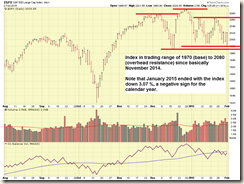

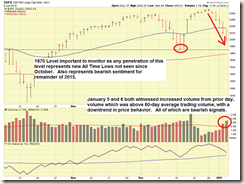

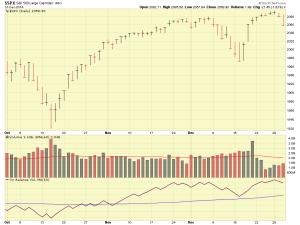

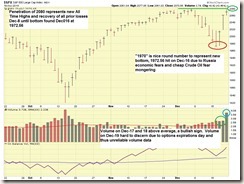

I am happy to report that this past Friday the 13th, while historically a day associated to bad luck and horror movies, turned out to be a positive day as far as the markets were concerned. The prior All-Time-High of 2093, set back in December, was overtaken, with the SP-500 index reaching 2097.03. Then on Tuesday February 17, the SP-500 index reached a new high of 2101.30.

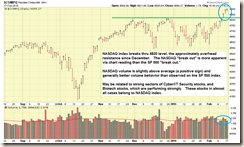

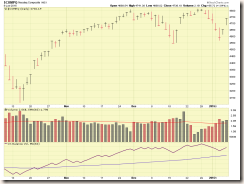

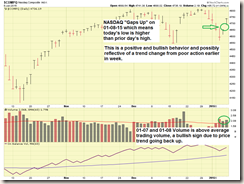

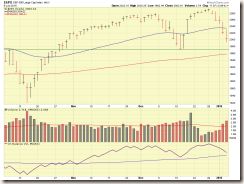

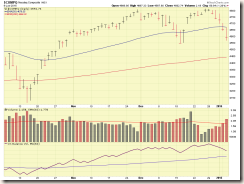

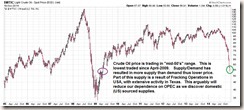

Note that these both occurred with the Ukraine “cease-fire” apparently not being entirely adhered to (surprise), and with the Greece situation still not resolved. Open source news is reporting that Greece may ask for a 6-month extension to their bailout terms (another surprise). So with both of these things in the picture, it appears that the markets have “priced in” these events. Lets take a look at some charts of the SP-500 and NASDAQ. Observe that in recent days, the NASDAQ index has displayed stronger volume and overall behavior than the SP-500. This could be due to recent strong performance in NASDAQ stock sectors of cyber and IT security and biotech stocks. Ok, lets look at some charts:

I currently remain 100% S-Fund. I hesitate to change fund allocations until I get a better “handle on” the various fund’s apparent future performance. Anyone who tells you “move to Z-Fund, it is doing the best, get in early” should be ignored. In times like these, after an extended sideways market (since basically November), at the present time, nobody can tell you what the individual funds are going to do. I my prior post I discussed three floating swimmers on their back. In this post I will use another analogy (I am a big analogy guy…), and state that the three TSP funds (S/I/C) are like three baby birds that just broke thru their shells. Which one will fly the farthest? No way to determine that right now. With that said, in 30 days (mid-March) we should have a better idea on what fund is performing best, which may provide insight into TSP allocation decisions.

On Wednesday February 18, the Federal Open Market Committee minutes will be released, at 2PM Eastern Time. These are the minutes from the January 28 FOMC meeting, and everyone will be over analyzing every word and vowel in the minutes, trying to determine when interest rates will be raised. I remain committed to my prior opinion that we will see rates increase in summer/fall 2015.

Again, I remain 100% S-Fund (a fine allocation, 50/50 S-Fund and C-Fund also fine). In mid-March, I will take a look at all funds and other relevant information for a potential TSP Allocation change in my account.

Please forward this update and this free website to your friends and colleagues, so that they too may benefit from trustworthy and accurate market analysis. This free site’s sole purpose is to educate and inform the TSP participant, with the belief that the educated participant can then make educated decisions, with a resulting positive performance enhancement to his TSP. As a fellow TSP participant, I have “skin in the game” along with you, and try to put out the correct balance of opinion, commentary, and analysis, without getting overly complicated or burying the reader in obscure economic theory or reports.

As we enter 2015, I have made a very conservative estimate that my ever growing multi-thousand subscribership represents a total of over $300M in TSP account funds. By all appearances, this site has been received very well.

Thanks for reading, talk to you soon…

– Bill Pritchard