Well, Argentina has successfully creamed US Markets, at least for one day, by defaulting on July 31 one minute past midnight. This default was briefly touched on in my June 29 post on this site. Interesting is that the Argentina default was not mentioned much in the “other” sites (to include Marketwatch, Motley Fool, etc.) until now. My June 29 post discussed my feeling that our markets will recover from this, which I still believe, but the fact remains that our markets have taken numerous hits over the last few weeks, and one is left to wonder when (and from where…) the knock-out punch will finally occur. The fact that the markets are still hanging on, is a reflection in my opinion that a recovery is not impossible. I don’t think anyone will argue the statement that the world is in challenging times right now.

The Dow Jones Index closed down 317 points, with both the Dow and SP 500 Indexes down for the month of July (July is now over). In my July 18 post I discussed some challenges facing the markets, and how the YTD returns for the TSP Funds have been lackluster. This assumes you were in the funds since January 1, your returns have been 6% to 7%. Now we have an additional challenge: Argentina in default. The various financial sites are linking today’s market sell-off due to multiple reasons (most sites have journalists behind them, not traders or folks with skin in the game). However, I purposely stayed up July 30 night from 10PM, 11PM, thru midnight, 1AM, 2AM, and literally watched the SP 500 Futures (which trade at night) rollover and go downhill in-sync with the approaching default, and past midnight, the default. Of course I was cringing on July 31 morning when Wall Street opened.

Now before we panic over Argentina, let me make some observations, listed below, about why I believe (aka “opinion”) that this is not something to panic over. Observe that I like Argentina as a tourist and have been to Buenos Aires and really enjoyed it. But, this is not about tourism.

Some Reasons the markets should not panic over Argentina

1. Argentina is not a player on the world economic or financial arena. China, England, Russia, Saudi Arabia, Japan, USA, are. If a country, via governmental policy or political actions, can cause financial harm to the United States, then they are a player. If not, they are not. This is my definition, not your typical definition Money Magazine definition.

2. Argentina produces no critical/crucial, products for the United States consumer (wine is not one of them), in which product price-change or currency rates may impact the United States. Argentina does not produce or source products for Wal-Mart’s zillion stores (China does), it does not produce crude oil, and it’s banks are not safe-havens (far from it) for money or locations of investment. Asia and Europe, are (amongst others).

3. No critical thinking, ground breaking thought or ideas, are coming from Argentina or any of Latin America for that matter. Japan brought us the Sony Walkman and the Honda Civic, England brings us a military and intelligence ally, and China brings us the ability to manufacture a zillion widgets for one dollar, keeping the price cheap for the consumer while allowing profits for the corporation. Korea builds the Samsung phone. If any of the above face a default, this could impact our country. Argentina ?

4. Argentina does not have a huge labor force used (via outsourcing) by US manufacturers. Such a labor force needs to be paid (currency rates), fed (food availability), retained (Company A offers better package than Company B), etc. Mexico does (Ford builds cars in Hermosillo). China, obviously, does (ask Wal-Mart). India does (call Citibank customer service, your call is answered in India). Argentina ?

So as you can guess by now, I don’t think (again, opinion…) that we should panic over Argentina. As I have touched on in prior posts, the markets REACT to things (another reason we, the investor, should REACT to the market, versus try to predict something that spends its entire existence itself reacting to other stuff). Panic and Greed are common reactions expressed by the market. As most of us know, in a panic situation (think “Fire” in a movie theatre), the masses flee out the doors without looking back at the progress of the fire or verifying if a fire indeed exists. It is everyman for himself. If a bunch of people are swimming at the beach and someone yells “Shark”, nobody is sticking around to verify that indeed a shark, and not another type of fish, is swimming in the area. The markets, composed of people, are no different.

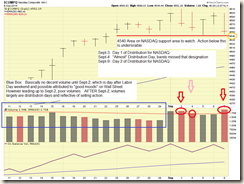

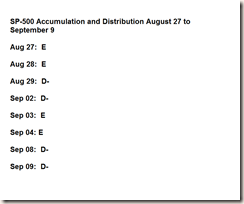

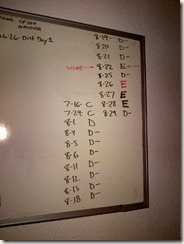

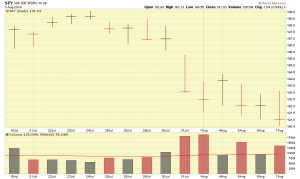

With the “you are starting to ramble” warning light illuminated, let me move forward to some charts. My opinions about Argentina aside, the market is indeed displaying weakness and has had numerous days of “Distribution” in recent weeks. This in almost all cases will send an index into a new downtrend.

1930 is our new support level to watch for the SP 500, which was hit today and represents that the index has been placed on re-wind back to June 15. All gains from June 15 to present have been erased.

With July 31 daytime trading now over, I am pleased to see that the SP 500 Futures (evening July 31) have recovered (slightly). This does not mean the bottom cannot fall out, but lets keep our fingers crossed.

As can be seen above, the evening SP 500 futures session may have “come to its senses”, with trading action having not gone below the July-31 day session.

In final testimony to my “we should not panic” argument, is Gold, the default “panic currency” which basically did nothing in response to Argentina. In theory, it should go up, as people panic because the world is about to end. Gold did nothing. See chart:

In summary, I am “monitoring the situation” and as discussed, the market indeed is showing signs of weakness. I remain 50% S-Fund and 50% C-fund however this can change at any time. Also, we need to watch the 1930 level on the SP 500 as any action below that is undesired.

I apologize for the long post, but a 300 point loss on the Dow Jones is not exactly “short story” material. I wanted to put forth my perspectives and opinion on what is going on.

NOTE: Fridays are typically bad days in general for the markets, as people tend to unload holdings prior to the weekend, in case the world ends over the weekend. Friday August 1 may be a down day, but this in and of itself may not be “additional bad news” it may be typical Friday behavior. The volume on the index will assist us in determining what is going on.

As always, please share this site with your friends and colleagues.

Talk to everybody soon and thanks for reading….

– Bill Pritchard

* This August 1 update released on July 31 / 11:15 PM CDT