Ok, drum roll…..can anyone guess what is rattling US Markets ? Who would have guessed ? Middle East problems and instability.

First, my TSP Allocation remains 100% S-Fund. Many subscribers will read that and stop there, and that is cool. For those who desire some additional opinion-based analysis, continue reading.

On June 12, the SP 500 index closed down, on increased volume, which is something not desired, then recovered (somewhat) on Friday June 13 and Monday June 16. The June 12 action was a direct result of the issues in Iraq, in which terrorists/insurgents associated to the ISIS Group took over key Iraq cities and executed hundreds if not thousands. Also, Ukraine/Russia is still hot, in light of numerous Russian President Putin (does anybody really believe this ex-KGB guy) statements that he is withdrawing from the region and/or is seeking peaceful options. Pro-Russian rebels just shot down an unarmed, Ukrainian IL-76 cargo plane, while it was inside Ukrainian airspace and territory. I suppose “in war”, anything can be targeted, but an unarmed cargo plane, legally and rightfully in position in their own country, just got blasted out of the sky, and at least in my opinion, it seems things are escalating, versus not, in Ukraine.

Most everyone has Fox News / CNN / etc., so I will not regurgitate what is already reported. I have posted on this site numerous posts in testimony to the market’s desire for stability (no matter what the topic: war, jobs, earnings) and the market’s desire for “knowns” versus “unknowns.” The markets, ultimately driven by people (traders, investors, etc.), are extremely sensitive to instability and unknowns.

When (sadly) thousands of US-trained/US-invested troops/forces in Iraq basically give up positions and flee hostile, invading forces (ISIL), this obviously was not received well by the markets. Iraq, an OPEC member, is a huge producer of crude oil and since the US-pull out, is a sensitive region and potential “breeding ground” for bad guys.

In classic “we may go to war” action, Crude Oil has jumped, Gold has jumped, and stocks have gone down. NOTE: Historically, in almost every case, once military action occurs or some sort of political/diplomatic solution is successfully implemented, the markets rally. See my prior posts on this topic, some of which are at:

http://www.thefedtrader.com/aug-27-update-war-markets-action-look/

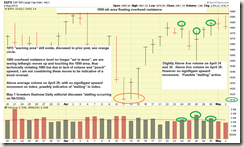

Lets take a look at a chart of the SP-500 Index:

As can be seen above, the index has somewhat found stability and attempted to resume its uptrend.

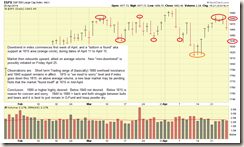

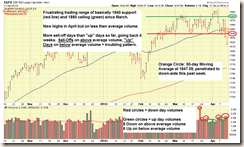

Charts of Crude Oil and Gold are below, with comments on the charts themselves. I prefer this as FYI only, we can’t trade Crude Oil or Gold in the TSP.

It should be noted that while all the indexes have gone lower, the best performer remains the S-Fund. The I-Fund (not surprisingly) has taken the worst hit over the last few days.

In other news, the International Monetary Fund (IMF) has reduced its “growth forecast” of the US Economy, in this article. While this is not necessarily good news, it may serve as ammunition for the anti-interest rate hike crowd and possibly suppress any rate hike date-acceleration (moving the planned date to a sooner date) that may be planned by FOMC. Or maybe not. Depending on how US elections go and the mood of our politicians, in light of other issues we are dealing with, how much we listen to IMF, headed by a French lawyer, is to be seen.

In summary, we are currently in some “Exciting Times” right now. My TSP Allocation remains 100% S-Fund. Any changes to this or other significant news, I will post it to this site.

Thanks for reading and please share this site with your friends and co-workers.

– Bill Pritchard