Hello everyone

To say that the last couple of weeks in the markets have been interesting, is an understatement. Like most of us, I am glad that August is behind us, leaving us with September as the worst performing month on a historical basis, for market performance. In plain English, of all the months in the year, stocks do the worst in September. October is the last of the “bad months” however October also has the reputation of being a month where many new bull markets have started. Coupled with September’s reputation, is the Syria crisis and ongoing concerns over Quantitative Easing (QE) tapering. Lets talk about some of this stuff. Before I proceed, allow me to state that I am still 100% S-Fund.

As some of you may recall, in my August 27 post, I discussed how the markets respond to war. In almost all cases, over history, the markets have entered an UPTREND once bombs get dropped and war is “declared.’” It should be noted that even on 9-11-2001, the markets went UP after that tragic day. They then entered a new downtrend, in 2002, due to other reasons not related to the 9-11 attacks.

One thing that I have observed, in the course of trading for the last 20 years, is that markets definitely do not like uncertainty or lack of clarity on important issues. Whether it be war, economic policy, the outcome of a presidential election, etc., markets do NOT like wishy-washy or uncertain energy in the air. Once a “stance” is made or a topic becomes more clear, the markets in almost all cases will respond immediately. Recently, President Obama made public his position regarding Syria, and the markets reacted to this and went up, once the leader of the most powerful nation in the world made his position known. While the politics and debates regarding the position itself have been argued, the fact that a position was established is what the markets responded to. And the markets continue to respond to potential progress, facilitated by Russia, a country which is reacting due to the established position expressed by President Obama and Secretary of State Kerry.

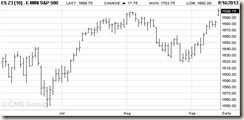

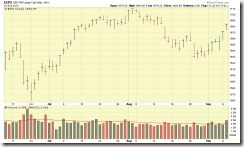

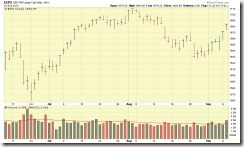

Lets take a look at the charts of the SP 500 Index, and how the index performed in relation to its 50-day, 75-day, and 100-day Exponential Moving Averages. These are moving trend lines that I use as one component of my trading system, to identify turning points and red flags, and determine trend direction. Recall that while I consider news and economic reports to be important, the ultimate trigger for market decisions is the market itself.

On today’s date, 09-10-13, the SP 500 index traded higher on above average volume, resulting in a “gap day.” A Gap Day is when that day’s low price, is higher than the previous day’s high price, resulting in a “gap” when displayed on a chart. Gap-Up-Days are a very reliable bullish indicator and in almost all cases, require the trader to establish a long/buy condition. The larger the gap, the stronger the move. Gap-Up-Days are signs of strength. See charts:

50/75/100-Day EMA Charts are below…last chart is a close-up view with comments:

Regarding QE tapering, it has been said that “good news is now bad news” and “bad news is really good news.” What does this mean? First, lets reflect on my previously discussed example of the US economy being a recovering hospital patient, and life support (QE) is no longer needed, due to the patient’s improved health. The doctors have decided that the patient needs to breathe on his own, and it is time to disconnect life support. With that concept in mind (and if CNBC starts to use it, you heard it on The Fed Trader first…) , good news that the economy is recovering is “bad news” because it increases the chances that QE will be tapered. Which, nobody wants, because the QE stimulant drugs are something we are all addicted to. So its better to have “bad news’” (poor jobs reports, poor economic news, etc.) as this means QE will likely remain unchanged for the foreseeable future. Clear as mud ? Does this make any sense ? (no). But that is what is happening, period, the end. It is not any more complicated than that. Just don’t tell the college professors who have authored white papers on the topic or the studies showing bond prices and treasury yields and how they will determine the market’s reaction to QE tapering. I mean, lets not make this hard folks. 1. QE exists. 2. QE will go away at an unknown date. 3. The market WILL react. 4. Responding to the market, not trying to predict it, is what we need to focus on.

For a refresher on not overcomplicating things and not trying to over analyze events, see my March 31 post on this site. A few college professors might take a look at it, which could be titled “You don’t need to be a meteorologist to know when to use an umbrella.”

Based on my observations associated to the charts and other indicators, I believe the markets have resumed their uptrend. My friends at Investors Business Daily newspaper announced this yesterday, on 09-09-13, but allow me to pat myself on the back and state that I was ahead of them already and never left the S-Fund. My opinion was the uptrend never really stopped, just had some struggles in August. At the present time, the I-Fund has outperformed the S-Fund based on a two-week “look back” basis, and may possibly continue to outperform the S-Fund. Due to some global turbulence, I prefer to be in S-Fund for now, but if you can tolerate some volatility, my opinion is that 50% I-Fund and 50% S-Fund would be a good combination. Me personally, I am still 100% S-Fund.

Please note that we have the rest of September to drive thru, then October, before the “worst market months” label no longer applies. In other words, expect some turbulence and speed bumps in the road until we clear October. With that said, any signs of life and new uptrends established in the worst market months, are great news, and I can only imagine how the markets will do once we get past October.

As always, THANK YOU for reading, and please share this site with your coworkers and colleagues. Thanks again

– Bill P.

http://www.thefedtrader.com/