Hello everyone

Today witnessed the market’s response to possible military strikes on Syria. As is typical when people respond in an emotional, panic-like state, their response is sometime without the benefit or consideration of planning or study. As they say, hindsight is always 20/20. Lets use some of this hindsight and take a look at war and markets.

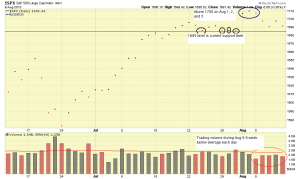

Allow me to display two charts of the SP 500, one showing the 1991 time period (US military planes attacked Baghdad on Jan 17 1991), and another one showing the 2003 time period (US military forces launched attacks on March 19 2003). I was unable to bring up charts prior to 1991 (such as WW-II, Vietnam, etc) but in summary, previous research has demonstrated that stock markets commonly rally, when the US gets involved in military conflicts. It can be further said that prior to US invasions, markets are typically in panic mode and/or declining.

Flash forward to 2013, and a strike on Syria is being mentioned on the news. Syria is akin to Iraq in many ways. Banned devices/materials. Civilian population being attacked by their own military. Middle East country. No identifiable useful export besides the mass production of problems and headaches. Same song, same dance, the only thing different is who is on the dance floor.

How do we respond to the sell-off on Aug 27 ? That is probably the “question of the day.” Please see attached charts. In light of my jumped-the-gun response regarding North Korea, in which I went to G-Fund, only to see the markets then go up, I am going to “hold position” in S-Fund right now. The North Korea situation was the threat of nuclear strike against the US, and in the absence of market data regarding strikes against US soil by other countries, I elected to move to G-Fund. No harm/no foul, but I must admit I got nervous and moved to G-Fund.

Starting to ramble…long story short, see charts….personally I am staying in S-Fund for the time being, and trying to keep emotions and nervousness away from my decision-making.

Thank you for reading. If you find this site useful or informative, please share it with your friends and coworkers. My TSP Allocation remains 100% S-Fund but obviously this is subject to change.

– Bill Pritchard