Hello everyone…

I wanted to provide an update and some insight into the recent market action. As many of you know, the country of Cyprus, an island smaller than the state of Massachusetts, and with less than 2M people, has undergone some financial difficulties. On March 15, the country’s banks were closed and the SP 500 Index closed down on very high volume in response to this. The next two trading days it also went lower. See chart below

Now, I don’t wish a financial crisis on anyone, so when I saw this in the news my first thought was “how will this affect the US markets.” Sometimes being a skeptic is a good thing, and for whatever reason, all headlines that the Cyprus crisis was “just the beginning of something bigger” (and it might be, but…) just were not ringing true with me. I mean, I just don’t know what Cyprus manufactures for the world markets or brings to the table. I don’t believe the US banks and financial institutions have much invested in Cyprus. Politically, we don’t have much to do with Cyprus, it’s not like we will count on them to bring their military horsepower to the table or need their political position to de-escalate tensions world hotspots.

So long story short, I don’t think Cyprus is a factor for the US markets. If the health of an important financial / military / political partner deteriorates, yes, that’s a problem. But in my opinion Cyprus is none of the above.

As discussed in previous posts, the “All Time High” (ATH) for the SP 500 was 1576, back in October 2007. The ATH is the highest point, it has reached, if even for a second. The highest close (the level it ended at prior to the close of the markets for the trading day) was 1565, on October 9 2007. Some financial press is starting to talk about this (I mentioned it here two weeks ago…). Both numbers are important, but the 1576 level is what I am personally watching. I think we will see this happen in 30-60 days. Please note, that any close above 1565 is still very significant. So when you have cable news on during the morning, we are looking for SP 500 1565 or higher. Not so much attention should be paid to the Dow Jones Index or NASDAQ. The SP 500 is a better overall snapshot of the market health.

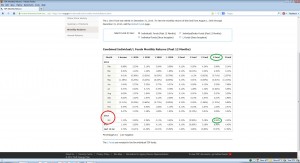

In summary, I think the S and C-Funds should continue to do well. A look-back at this month’s performance (and the month is still not over) via my proprietary TSP performance tracking system, reflect that the S-Fund will likely come out as the leading fund this month. However, C-Fund is running pretty close to the S-Fund, performance wise. I am personally 100% S-Fund but 50% S-Fund and 50% C-Fund is fine also.

Don’t get distracted by some purported experts who claim the markets have “topped out” and “will crash soon.” Please continue to utilize this site for trustworthy information and insight into what is happening.

If I see any red flags or warning signs, I will advise everyone. Thanks for reading, and thank you for the numerous emails complimenting this site. I have had the fortune to speak to some of you on the telephone, and its really great to have such a great group of folks reading this site. Thank You.

– Bill Pritchard