Hello

Monitoring the news media, there is no agreement yet on the resolution to the Fiscal Cliff situation. The Washington Post has reported that an unofficial deadline is Sunday Dec 30 at 3PM Eastern Time.

“….Reid and McConnell have set a deadline of about 3 p.m. on Sunday for cinching a deal. That’s when they’re planning to convene caucus meetings of their respective members in separate rooms just off the Senate floor. At that point, the leaders will brief their rank and file on whether there has been significant progress and will determine whether there is enough support to press ahead with a proposal.

“They both know the clock ends Sunday,” said Sen. Mark Begich (D-Alaska)….”

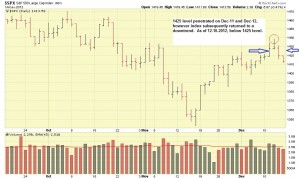

With that said, we are almost one hour from that deadline now (I type this at 1:50 PM Eastern time). The SP 500 futures are not trading yet, but will trade this evening electronically. Worldwide traders have access to the SP 500 futures, and these are extremely reliable indicators of “sentiment” and response to market forces, such as the Fiscal Cliff situation. It will be interesting to see how they trade tonight. They closed on Friday at 1388.

I will update everyone tonight. Thank You

Bill Pritchard