Hello Folks

Well as we finish up the week, my immediate observation over the last few days is that the market volumes are very low. The fundamental/economic situation aka “background” has not changed (and how could it, my last update was merely six days ago), and I still see no justification to leave the G-Fund in pursuit of questionable upticks.

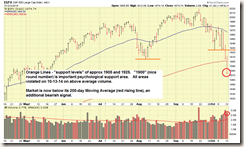

It should be noted that the SP 500 Index made a new All-Time-High (“ATH”) on August 26, attaining 2005.04. This is a new, all time, historical high. Now, many will recall that I love ATH’s, and if you trade a personal stock account, when a stock makes an ATH, this is a very reliable signal to buy some of that stock. I don’t want to get side-tracked on personal trading, but the concept is equally important when looking at the indexes. However the ATH “buy signal” must, or almost-must, always have above average volume with it.

Above average volume is reflective that the underlying event (the ATH), is sustainable, as there are “voters” (buyers) in large numbers, behind the move. Versus a floating sailboat on the lake which just, by the stroke of luck, caught a breeze towards Bull Market Island. A light breeze and a random drift, even if in the “correct direction”, does not equal a clear cut path, with sustainable force.

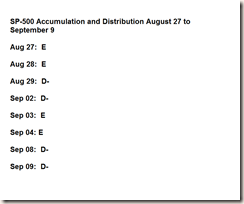

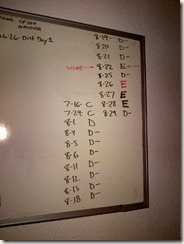

It should be noted that Bull Markets need volume to propel and to sustain them, but Bear Markets can fall apart on their own. Volume is not a requirement to make a market cavitate and go down. That’s what makes this particular situation somewhat dicey, we have a mature Bull Market (depending on what indicator you are using, most accept that the current Bull Market has existed since late 2011), and the volumes are starting to dry up. Furthermore “Institutional participation” (pension fund plans, mutual funds, hedge funds, etc.) is slowing down. Institutional money is what moves markets, not Uncle Raymond with his E-Trade account. Investors Business Daily measures this in their Accumulation/Distribution Rating. Basically “A” is strong buying (which tends to send stocks upward) and “E” is heavy selling (which tends to send stocks downward). Heavy selling is a bad sign. Unfortunately, while our sailboat apparently caught a breeze and sent it upwards, since August-1, the SP 500 distribution has hovered between D and E distribution.

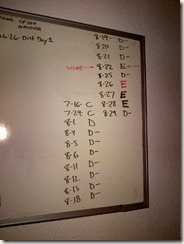

I use the Accumulation/Distribution Rating as one of many tools to assess the temperature of the market. See photo of my whiteboard at home, with dates and accompanying rating, below:

I do this every evening, as a “supplemental tool” in addition to other tools in my system. Notice a few “E” ratings over the last few days. The highly desirable “A” or “B” are nowhere to be found.

Gee Bill, that is great, but can you give us some charts of what we should see ?

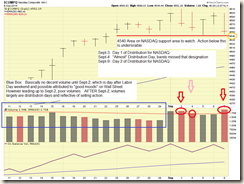

Yes, of course, lets take a look at the chart of the SP 500 back in March 2003. Note that “war” is a major catalyst for the markets (FAQ #6) and back in 2003, we were not battle fatigued like most agree our country is now. Sept-11-2001 was still very fresh in our memories and the nation was “coming together” and being patriotic on all fronts. We also (in 2003 to 2008) had a major housing boom (inspired as we now know) by some easy lending and mortgage activity. People bought houses, and send bank stocks, home builder stocks, Home Depot stock, etc, higher. Lets take a look at the 2003 charts, with no comments, and with comments. Pay special attention to the VOLUME activity.

That is what we are looking for. Now, I doubt we will see those kinds of volumes now, as in March 2003 most folks were out of the market, having been hurt in the previous cycle of NASDAQ 2000 crash. So the swimming pool had water but no swimmers. In March 2003, the whole neighborhood jumped into the pool and a resulting major splash was seen on the volumes. Today, 2014, in our three year old (or so) Bull Market, those who are inclined to buy stocks, are already in stocks. So a legit question to be asked is “who is on the sidelines that can come in and send stocks higher.” And by looking at the Accumulation/Distribution ratings, the institutional investors are exiting, versus entering, stocks.

Lets take a look at the charts, without comments and with. Keep the above volume observations from the 2003 charts, fresh in your mind, as you look at the August 2014 volumes while the market is “making new record highs.” Again, hey, I would rather have a new high versus a new low, as I am the last guy who wants to spend his life in G-Fund, but the fact remains that the volumes are low and things are still questionable, in my opinion. Charts:

Lets take a look at a closer up view now:

You can see the clear uptrend, past the 1990 area (area of prior resistance) but the volume just isn’t there. Now: If we get just one day (ok, maybe two) of above average volume, with the index closing higher than the open, with clear, obvious, “thrust” upward, I will be back in C or S fund. I will send everyone letters of apology for those who spent August in G-Fund. Just remember, the recent “uptrend” has been on low volume. Volume is as important, if not more important that the actual price movement itself of the underlying index or stock.

A very easy, non-chart, way, to monitor volume is go to Yahoo Finance and look at the SPY ETF, which tracks the SP 500. I apologize for the full size image with all the white space, I am cutting and pasting screenshots past midnight on minimal sleep….

So, you can use the SPY ETF to monitor volume. If the individual trader gets a grasp of volume and trend direction, you can enhance your performance greatly.

OK, most folks are worn out by now with all this volume talk. Long story short, I remain 100% G-Fund, pending some volume increases and “reassurance” that these new highs are sustainable.

I will be monitoring things and any major events, I will post an update on this site.

Thanks and everybody have a good Labor Day weekend. Markets are closed on Monday Sept 1, FYI. Friday Aug 29 volumes should be very light, as Wall Street prepares for the long weekend.

– Bill Pritchard