Good Evening

Last week was not pretty in the markets, US indexes and the international indexes witnessed severe losses on above average volume. This is reflective of institutional selling, which is clearly a “red flag” and reason to moving the trigger finger closer to the G-Fund. The sell-off in the markets appears to be attributed to financial problems in Argentina, in which inflation rates of over 30%, currency valuation issues, and low currency reserves, have prompted fears for international markets. The worst performing markets last week were Argentina, France, and Germany. Not surprisingly, the I-Fund was hit hardest last week, C-Fund next worse (#2 place on the worst list), and S-Fund being hit but escaping with the least damage.

Some fear that Argentina, running out of currency reserves (have we seen this show before?) , may default on current debt obligations, which will impact the lenders and impact credit ratings. Seeing this, institutional investors likely got nervous and bailed out of other emerging and international markets. The problems started Thursday, and continued into Friday.

My analysis of this, is that this was “panic selling” akin to when someone yells “Fire” in a movie theater. Nobody is sticking around to analyze the fire, or how fast it is spreading. People are just hitting the exits, and will look back once they get outside. With that said, it is my opinion that institutional money bailed out on Thursday, and on Friday, they continued to hit the exits because they did not want any surprises over the weekend. They could “rest easy” over the weekend, knowing that they had liquidated positions and were out. Hopefully, on Monday Jan 27, people will reassess things and decide that Thursday and Friday were overreactions based on fear and not fact. The following observations prompt me to believe that the US economy is back on track and things structurally are improving, home in the USA. These are all available via google search, I have assembled some of them here:

1. 2013 home sales numbers higher than any year since 2006

2. Improving labor market evidenced by reduction in jobless claims data

3. Lower foreclosure rates (admittedly this may not mean anything, most foreclosures were related to 5-year ARM mortgages, and the peak of the housing cycle was approximately late 2007, more than 5 years ago.) In other words, the “real estate boom foreclosure” cycle is behind us, if using the 5-year ARM as a reference point

4. Record new car sales numbers in 2013

5. Record numbers of airline travelers, and airlines ordering record numbers of new airplanes, and hiring pilots.

6. Gold prices in a downtrend, which began in late 2012. “Safe haven” investment of gold loses favor in good economic climates as investors pull their money out of gold seeking better returns elsewhere, typically in stock markets.

7. Corporate Earnings, Retail Sales data generally improved in 2013 over 2012. I say generally because one needs to view this with a grain of salt. “Sears reports poor earnings” or “Kmart has a bad year” does not necessarily mean that Joe Customer is broke / unemployed / bankrupt and therefore not shopping and stimulating things. He is possibly one of many customers who are spending their dollars via Amazon.Com or at other stores, and saving gas and not having to park the car. Just FYI when someone tells you that America is doomed because the local K-mart is empty. Actually, America may be better off without having to step on gum in the parking lot, walking around a spilled Slurpee in the aisle, and old hot dogs spinning on the warmer, and two out of 10 cash registers staffed, all part of the “shopping experience” I have had myself.

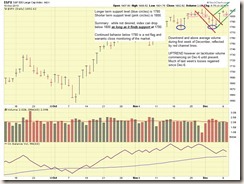

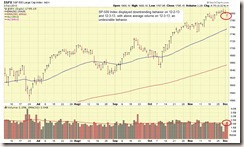

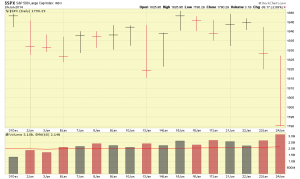

Readers will recall my observations that the I-Fund was performing well in January, but I stated that I wanted to give things a little more time before making any decisions regarding the I-Fund, which (over the last few years) is hyper-sensitive to world political problems and economic concerns. While we are on the subject of January, the January Barometer is not looking good right now. Some may recall that this indicator predicts how the markets will perform for the rest of the calendar year, with an accuracy rate of 90%. Lets take a look at the SP 500 Chart so far, from the start of January until present:

As can be seen, we are currently not “up” in January. This concerns me, as the January Barometer is a highly accurate predictive indicator for the year to come. We have five more days of trading left, Jan 27, 28, 29, 30, 31, and January is over, done, El Fin. We need some miracles this upcoming week because that is what it will take to go from 1790.29 (Jan 24 close), and go above its highest close of 1848.38 (Jan 15), a which means that in one week the SP 500 has to gain 58 points. Think of this as a football game, and as far as January is concerned, we are in the last quarter. The markets have to regain some points if the January Barometer is used as a yardstick for the year. 1848 is the key level we are watching, for those CNN/CNBC ticker watchers. 1790 is the key low to watch, anything below that, and a cautionary move to G-Fund is almost obligatory. Some of the “ride it out, it will come back” fans will surely email me (as they always do) but hey, I know what I am gonna do. Control the bleeding and seek cover and concealment.

I have no additional charts or graphics this post, I wanted to mostly address what happened Thursday and Friday and provide my analysis.

For now, my TSP Allocation remains 50% S-Fund and 50% C-Fund.

However, I am very close to moving to G-Fund, which I hope does not occur, based on my opinions above regarding the US economy and the reasons the market sold off last week. Hopefully, calmer minds surface next week and the markets recover. At the end of the day, the market knows all, and opinion, speculation, theory, do not matter and we must respond to the market itself. Let’s all be heads up next week as to how things play out.

Thank you for reading….

Bill Pritchard