Hello Folks

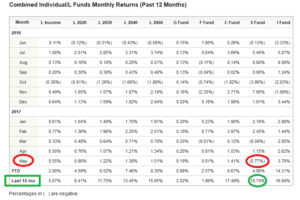

Bottom Line Up Front: My current TSP remains 50% C-Fund and 50% I-Fund.

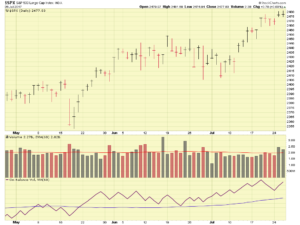

This month of August has been a painful one, with three major distribution days on the SP 500, indicating that institutional investors were selling shares and exiting positions. The entire summer has been rather painful, additional distribution days are apparent on the chart of the SPY Exchange Traded Fund (ETF) which is a useful proxy for the SP 500 Index:

You may recall prior postings discussing distribution days: Numerous days over the span of weeks can serve to end any uptrend which exists. In simple terms, multiple distribution days can send the market lower. We indeed have increased risk ahead that the market can go lower. With that said, here is my reasoning behind my own TSP Allocation, and my logic as to why I am not changing anything. At least not yet.

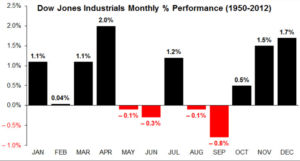

- History tells us that summers suck. “Summer Doldrums” is one term used. The worst month, is ahead – historically it is September, once we clear September, we may resume an uptrend. Or not. With this data point, we should not panic yet: summers are always difficult. And summer is almost over.

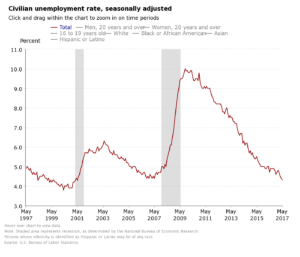

- The US economy is strong. People are employed, housing/real estate (in most markets) is tight, airline flights are jam-packed, and consumer spending is up. Note: Decaying and vacant big box stores and shopping malls are not an indicator. Consumers are spending like never before, however fighting for a parking space and walking a mile in the sun, risking skin cancer, to the entrance of the mall, only to discover your pant size is out of stock (but “our store across town at Valley Springs Mall has them in stock”) is a thing of the past. Spending continues – It is called Amazon.

- The world economy continues to improve. At the recent World Central Bankers Meeting in Jackson Hole, Wyoming, which concluded on August 25, the lead economist for the International Monetary Fund (IMF) reports that the world is seeing a broad-based recovery.

With that said, could things go south ? Sure, anything can happen. Do I think things will go south ? No, my opinion is that once we clear September, the markets will resume an upward trajectory. One speed bump in the path however is the threatened government shutdown, threats which are tied to the Border Wall and the federal budget. In sum, when the most senior management of world’s most powerful nation cannot agree on a path forward, this hurts our credibility and “brand”, it also costs money: $24 Billion was the cost of the 2013 shutdown according to Standards and Poor’s, the same company which created the S&P 500 index. Contrary to popular belief, shutdowns are never “good” and they are never healthy for an otherwise choppy stock market.

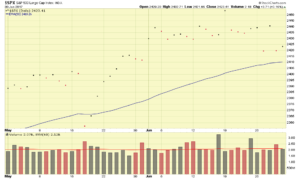

With that said, I am optimistic and remain in the aforementioned TSP funds. While my personal returns have been less than desired in the I-Fund and C-Fund, I am electing to remain there, as my belief remains that if Congress and the Oval Office can get on the same page, those two funds will see the best returns. Note that even with the poor summer performance, the markets remain at their 50-day Moving Average lines (a trend identification tool), and well above their 200-day Moving Average lines:

This behavior reflects that the trend of the market remains upward.

I get quite a few messages and questions regarding various magazine and newspaper (print or online versions…) articles that claim the market will crash any day, and that doom is around the corner. There are even a few internet chat groups out there, dedicated to stock discussions, claiming the same. The best defense to all the noise is studying the markets and learning how they work.

I invite you to read about the “Magazine Cover Theory” which claims that when a “hot topic” is appearing on magazine covers, then that fad or topic is about to be dead, or reverse course. A link about this theory is here: http://www.businessinsider.com/the-fascinating-theory-that-the-economist-magazine-covers-are-like-cabbies-offering-share-tips-2016-10

That is all for now….be safe out there and talk to you soon.

Thank you for reading

Bill Pritchard